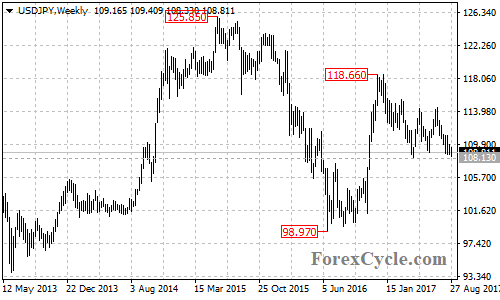

USDJPY moved sideways in a trading range between 108.13 and 115.50 for several months and is now facing the previous low support level at 108.13 once again.

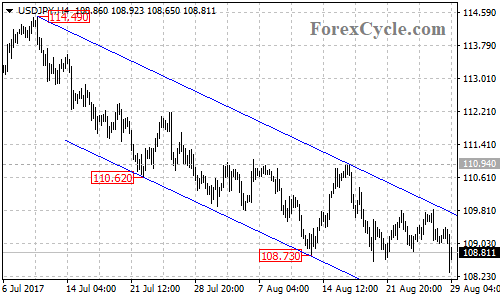

On the 4-hour chart, there is a bearish price channel with resistance at the top trend line now at around 109.80. As long as the price is in the channel, the downside movement from 114.49 could be expected to continue. A breakdown below 108.13 support could signal resumption of the downtrend from 118.66, then next target would be at the 61.8% Fibonacci retracement taken from the June 2016 low of 98.97 to the December 2016 high of 118.66 at 106.50, followed by the 76.4% retracement at 103.60.

On the upside, a clear break above the top trend line of the channel could take price back to next resistance level at 110.94. This level could be treated as the key resistance of the short term downtrend from 114.49, above this level could indicate that the downtrend had completed at 108.33 already, then the following upside movement could bring price back towards 115.50.

For long term analysis, the fall from 118.66 would possibly be correction of the uptrend from 98.97. Further decline would more likely be seen and a breakdown below 108.13 key support could trigger another fall towards 103.60, and the 103.60 level would be the final target of the correction pullback.

Technical levels

Support levels: 108.13 (April 17 low), 106.50 (the 61.8% Fibonacci retracement), 103.60 (the 76.4% Fibonacci retracement).

Resistance levels: 109.80 (the top trend line of the price channel on the 4-hour chart), 110.94 (the August 16 high), 114.49 (the July 11 high), 115.50 (March 10 high).