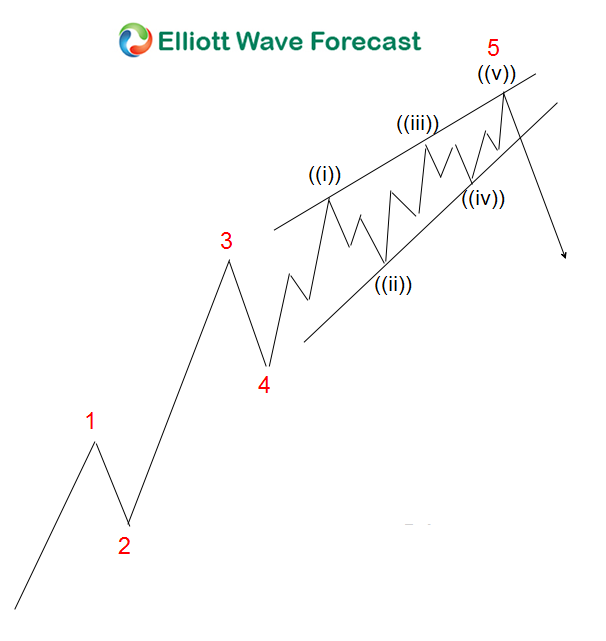

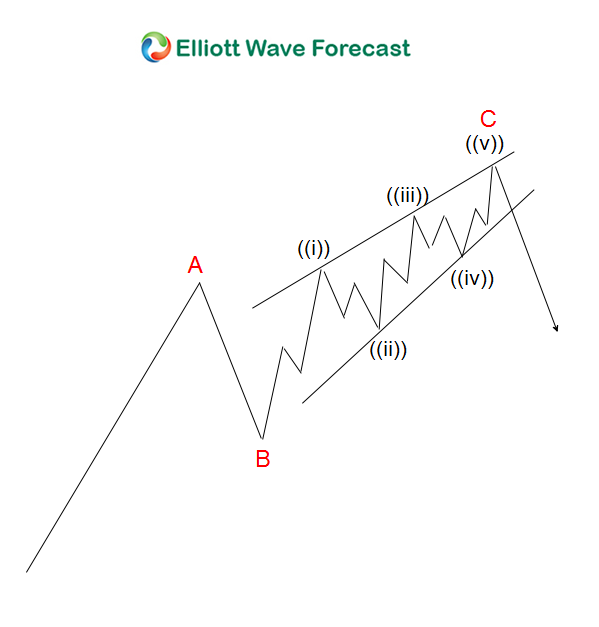

An ending diagonal is a type of impulsive motive wave in Elliott Wave Theory that will be found in the subdivision of fifth waves or whole C waves in a structure. An ending diagonal C wave or 5th wave commonly shows an obvious wedge shape with an overlapping wave 1 and wave 4. These will subdivide into 3-3-3-3-3 however an overlapping wave 1 and wave 4 are not required conditions that must be met. The overlap may or may not happen thus it is acceptable for there to not be any overlap. These structures will appear in either bullish or bearish markets in all time frames. For reference shown at the bottom there is a couple of bullish examples the above mentioned wave C’s & 5th’s describes.

There are a few conditions that ending diagonal waves have in common with a regular impulse. Firstly the whole structure will be five waves however it will subdivide into the aforementioned 3-3-3-3-3 instead of 5-3-5-3-5. Secondly the wave three will not be the shortest of the five wave move thus either the wave one or the fifth wave will be shorter than the wave three. Finally the fifth wave of a bullish market ending diagonal will have a lower momentum reading such as on a RSI indicator where it will be showing some divergence compared to the wave three. Correspondingly in a bearish market ending diagonal the wave three will have the lower momentum indicator or RSI reading when compared to the wave five.

Keep in mind a five wave motive, whether a regular impulse with the 5th wave being an ending diagonal or an ending diagonal wave C itself will be commonly seen in the larger double three combination structures such as in the C wave ending moves of zig-zags as well as in flats of each of the three types which can be seen here.

Thanks for looking and feel free to come visit our website and take a trial subscription and see if we can be of help. Kind regards & good luck trading.

Lewis Jones of the ElliottWave-Forecast.com Team