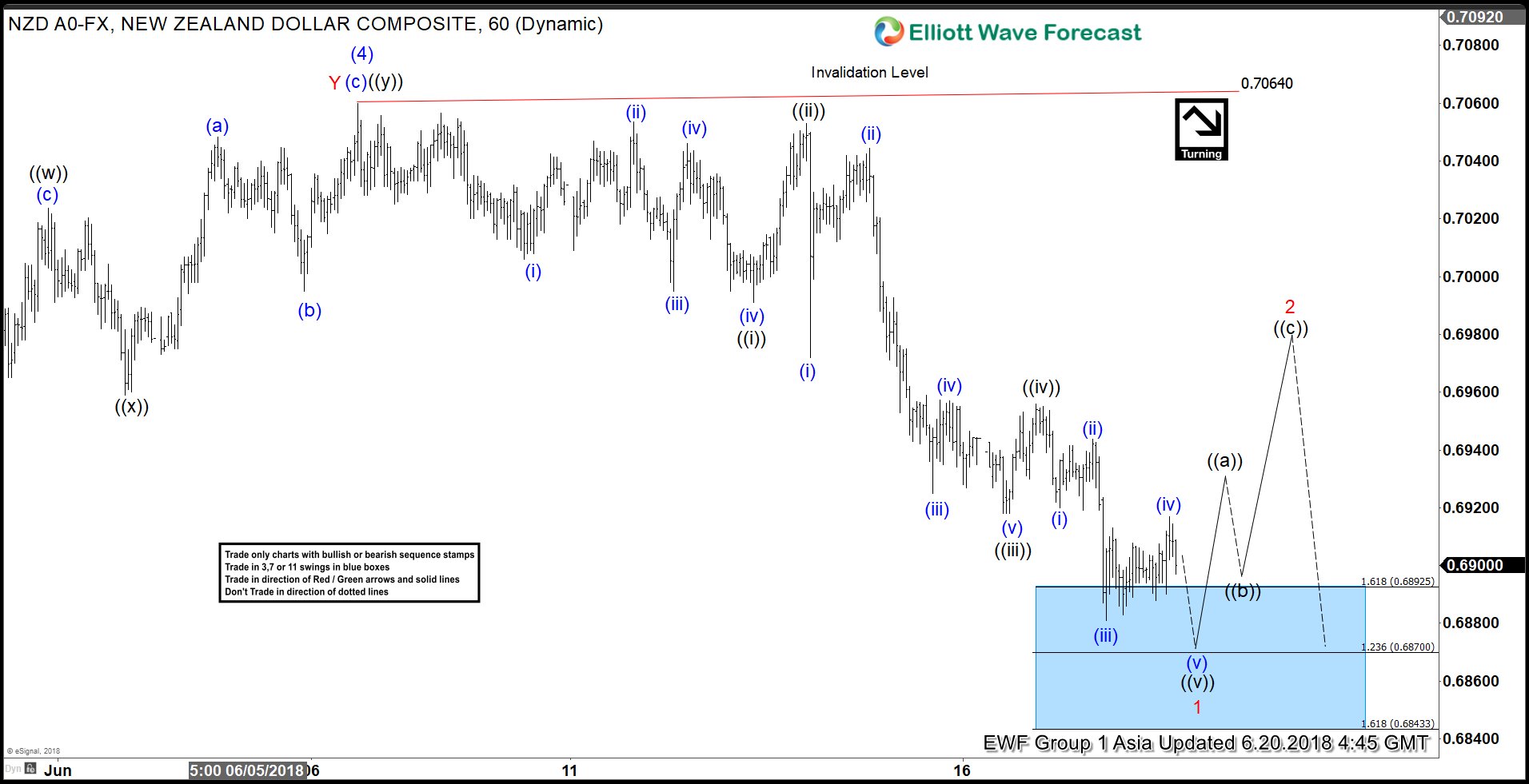

NZDUSD short-term Elliott Wave view suggests that the bounce to 0.7060 high ended intermediate wave (4). Down from there, the decline is unfolding as Impulse Elliott Wave structure where sub-division of Minute wave ((i)), ((iii)) & ((v)) are unfolding in 5 waves within a lesser degree cycle. On the other hand, the corrective Minute degree wave ((ii)) & ((iv)) should unfold in any 3 wave corrective sequence, such as zigzag, double three, flats.

Down from 0.7060 high, the pair ended the first leg lower in 5 waves at 0.6991 low in Minute wave ((i)). Minute wave ((ii)) ended at 0.7053, Minute wave ((iii)) ended at 0.6918 low in another 5 waves. Up from there, the bounce to 0.6955 high ended Minute wave ((iv)). Below from there, Minute wave ((v)) of 1 remains in progress in another 5 waves structure. Pair has already reached the minimum target in blue box, thus cycle from 0.7060 high is mature. Once Minor wave 1 is complete, pair should bounce in Minor wave 2 in 3, 7 or 11 swings before the decline resumes, provided pivot at 0.7060 high stays intact. We don’t like buying the pair in the proposed bounce.

NZDUSD 1 Hour Elliott Wave Chart

Source : https://elliottwave-forecast.com/forex/nzdusd-ready-3-wave-recovery/