The capitalization of the Bitcoin cryptocurrency futures market of CME Group has decreased by 2%.

The total capitalization of the derivatives markets at BTC/USD was $156 million.

A slight decrease in investors’ blocked positions of less than 1% indicates unidirectional movement during the current trading week.

In monetary terms, the volume of investors’ locked positions in Bitcoin futures amounted to $8 million.

Overweight buyers Bitcoin Futures decreased by 9%. In monetary terms, the total net overweight of buyers amounted to $ 8 million.

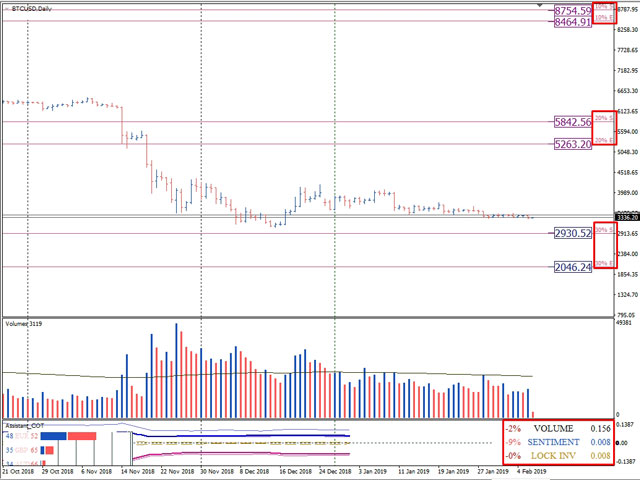

The nearest area of support on the daily timeframe is the long-term region of 30% of sellers (2930.52-2046.24).

The nearest area of resistance when doing business within the current month is the long-term zone of 20% of sellers (5263.20–5842.56).

In the event of a breakdown and consolidation of the above indicated resistance area, the next growth guide is the zone of 10% of sellers (8464.91–8754.59).

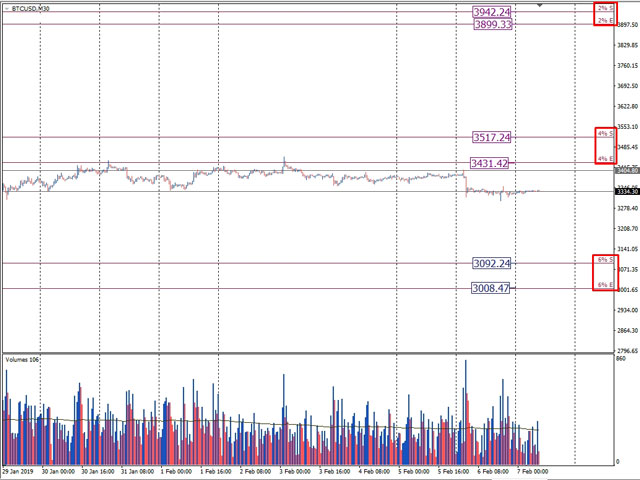

The key area of resistance today is the zone of 4% of sellers (3517.24-3431.42).

The immediate goal of growth is the zone of 2% of sellers (3899.33-3942.24).

The key reference point for the reduction for the current working week is the zone of 6% of sellers (3092.24-3008.47).

Dmitry Zeland, analyst at a brokerage company MTrading.