The capitalization of positions of CFE-accountable participants of the CME Group on derivatives for Canadian dollar increased by 1%. The total capitalization of derivative markets for the Canadian Dollar reached $ 25 billion 21 million.

The preponderance of bullish positions increased by 3%. In monetary terms, the preponderance of buyers amounted to $ 9 billion 710 million.

Over the previous week, investors increased the number of closed positions by less than 1%.

Also worth noting is the following ratio of capital investment in derivatives on USD/CAD among SMART MONEY: 69% of buyers and 31% of sellers.

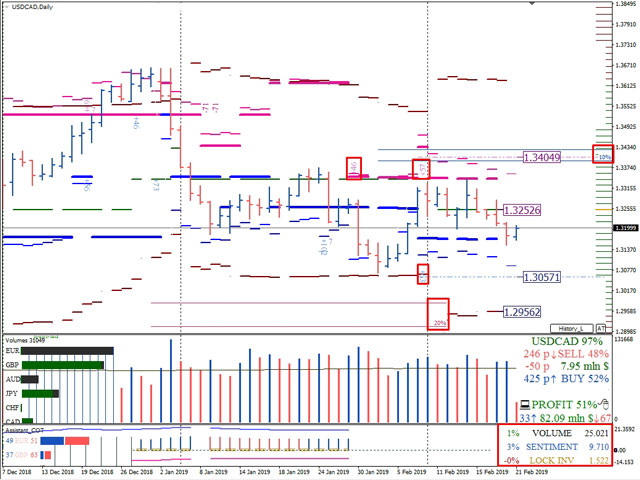

The nearest long-term level of support on the daily timeframe is the monthly option level of adding $ 53 million for growth (1.3057).

The next area of support on the daily timeframe is the long-term zone of 20% of sellers (1.2980-1.2912).

The closest resistance on the daily timeframe is the monthly market maker balance (1.3252).

The next growth target for trading within the current option month is the monthly level of growth in selling positions with a total volume of $ 103 million at a price mark of 1.3404.

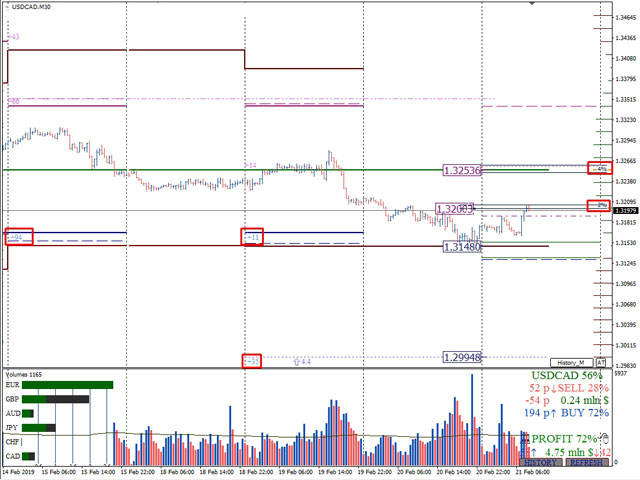

The immediate support for today is the level of the beginning of the loss of the market maker for weekly options (1.3148).

Subsequent support is the optional growth rate of $ 35 million for growth on weekly contracts (1.2994).

The closest resistance area for intraday trading is the 2% of buyers zone (1.3199-1.3205).

The next growth target is the weekly market maker balance of 1.3253.

Dmitry Zeland, analyst at a brokerage company MTrading.