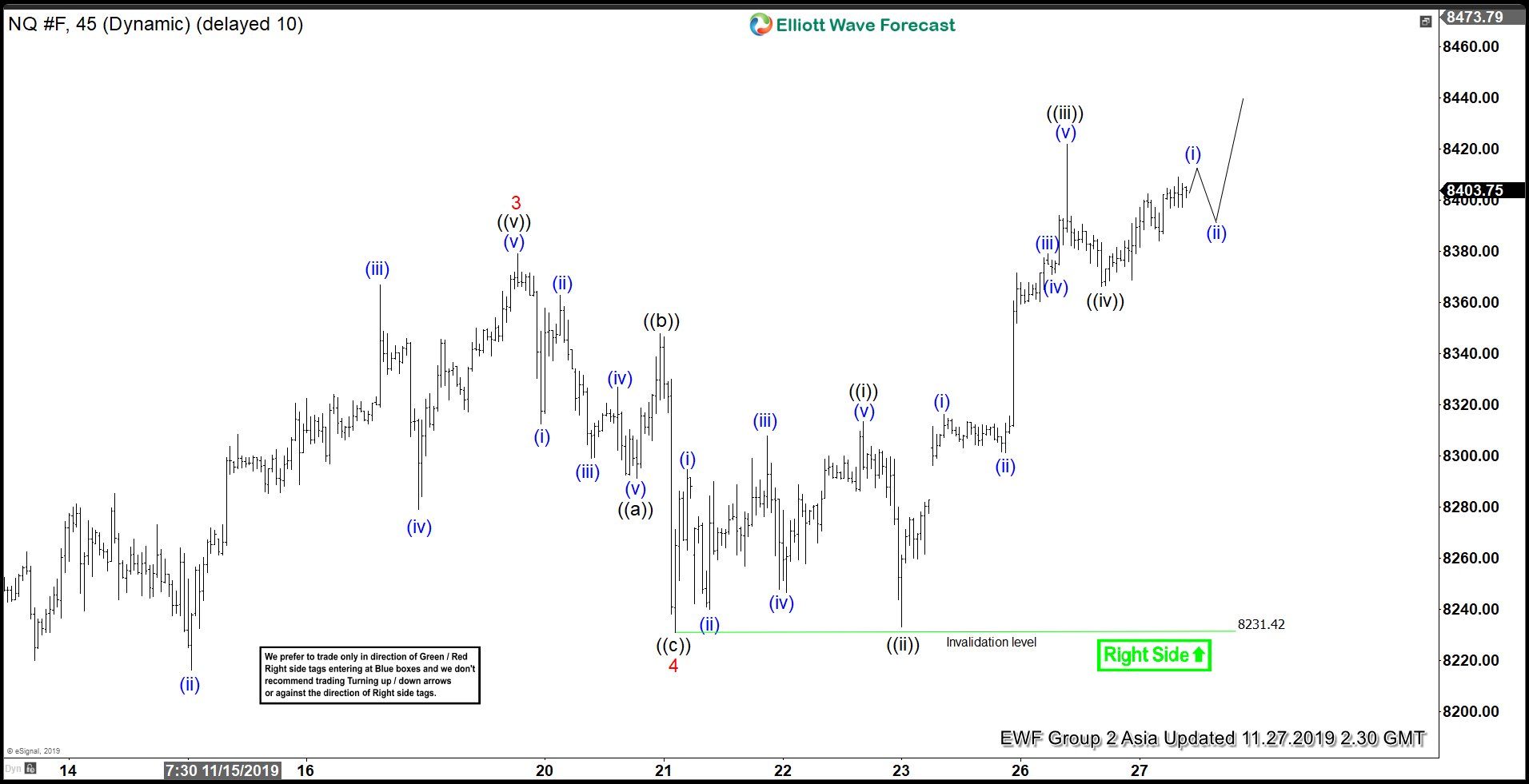

Elliott Wave View in Nasdaq (NQ_F) suggests that the rally from October 3, 2019 low is unfolding as 5 waves impulsive Elliott Wave structure. On the chart below, we can see wave 3 of the impulse from October 3 low ended at 8379. The pullback in wave 4 ended at 8231 as a zigzag Elliott Wave structure. Wave ((a)) of 4 ended at 8291.50, wave ((b)) of 4 ended at 8348 and wave ((c)) of 4 ended at 8231. Wave 5 is currently in progress as an impulse.

Up from 8231 low, wave ((i)) of 5 ended at 8313.50 and wave ((ii)) of 5 pullback ended at 8233.25. The Index then resumes higher again in wave ((iii)) of 5 towards 8422. Pullback in wave ((iv)) of 5 is proposed complete at 8366.25. Index still needs to break above wave ((iii)) at 8422 to avoid a double correction in wave ((iv)). Near term, while pullback stays above 8231.4, expect Index to extend higher. We don’t like selling the Index. Potential target higher is wave ((i)) = ((v)) towards 8447 – 8497. As far as pivot at 8231.4 low stays intact, dips should find buyers in 3, 7, or 11 swing.

NQ_F 1 Hour Elliott Wave Chart