In this technical blog, we are going to take a look at the past performance of the 1 hour Elliott wave charts of Bitcoin ticker symbol: $BTCUSD. In which, the rally from June 27, 2020 low ( $8830) showed an impulse rally higher favored more upside extension to take place. Also, the right side tag pointed higher & favored more strength. Therefore, we advised our members to buy the dips in Bitcoin in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

Bitcoin 1 Hour Elliott Wave Chart

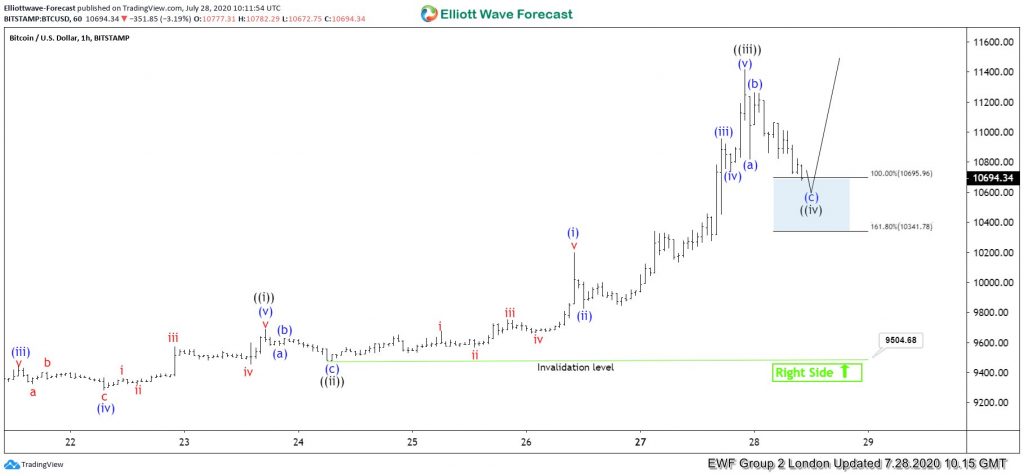

Bitcoin 1 hour Elliott Wave Chart from 7/28/2020 London update. In which, cryptocurrency is showing an impulse rally with extended wave ((iii)). Whereas wave ((i)) ended at $9690. Wave ((ii)) pullback ended at $9504 low and wave ((iii)) ended at $11417 high. Down from there, Bitcoin entered wave ((iv)) pullback to correct the short term cycle from $9504 low. The internals of that pullback unfolded as a zigzag structure where lesser degree wave (a) ended at $10816 low. Wave (b) ended at $11263 high and wave (c) managed to reach the blue box area at $10695- $10341 100%-161.8% Fibonacci extension area of (a)-(b). From there, the pair was expected to resume for wave ((v)) or for 3 wave reaction higher at least.

Bitcoin 1 Hour Elliott Wave Chart

Here’s Latest 1 Hour Elliott Wave Chart from 7/30/2020 Asia update. In which, Bitcoin is showing reaction higher taking place from the blue box area. Allowed members to create risk-free position shortly after taking the long positions. However, a break above $11417 high still needed to confirm the wave ((v)) & a possible extension towards $11614- $11933 target area.