Hello Everyone! In this technical blog, we are going to take a look at the Elliott Wave path in The Real Estate ETF (IYR).

The iShares U.S. Real Estate ETF seeks to track the investment results of the $DJUSRE index. The index is composed of U.S. equities in the real estate sector. It provides exposure to U.S. real estate companies and REITs, which invest in real estate directly and trade like stocks.

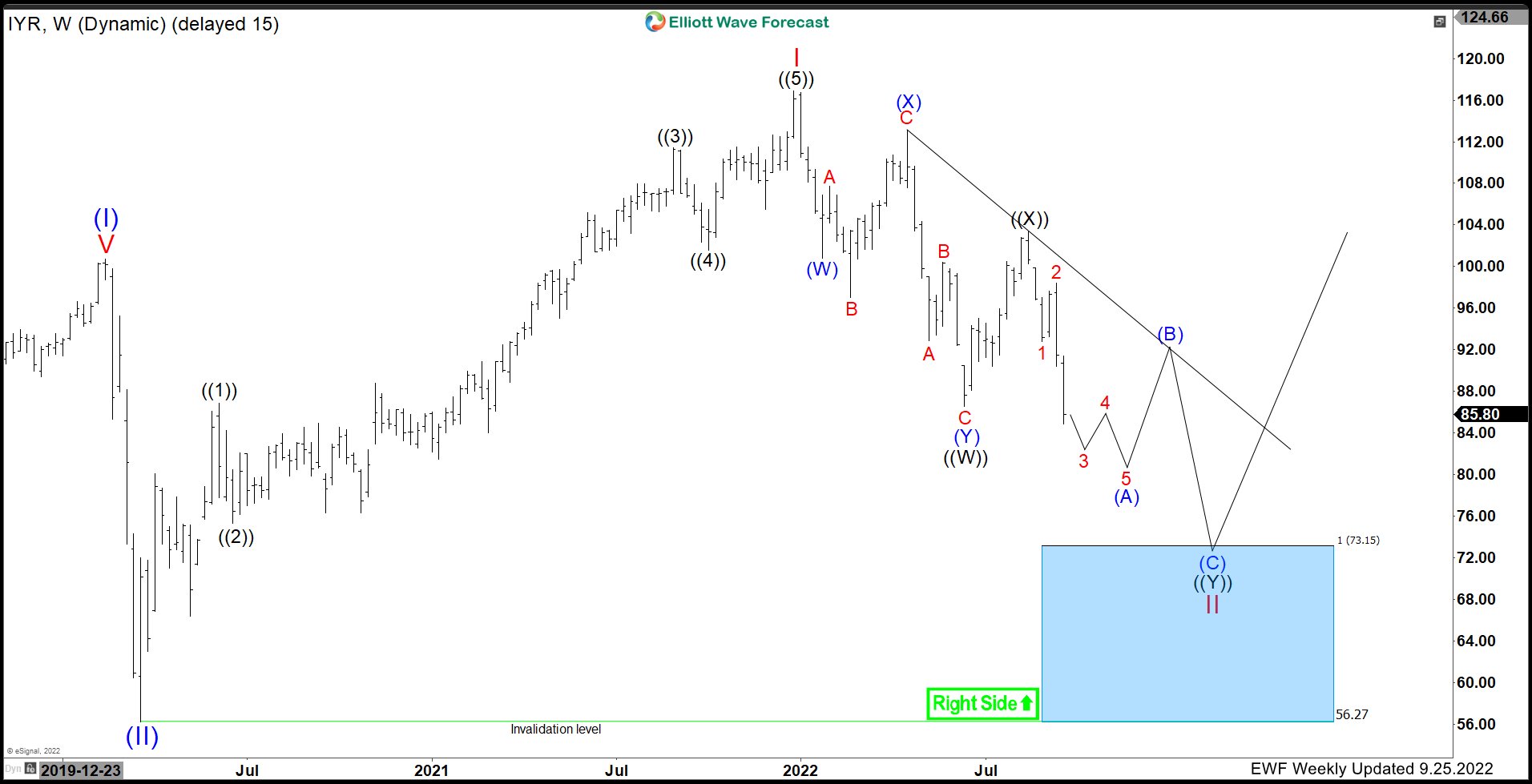

In the initial article from July 2022, we forecasted a bounce to take place from the blue box area. The bounce took place allowing longs to get risk free but then failed and continued lower. Lets take a look at the updated Elliott wave path that can be unfolding.

IYR (Real Estate) Weekly Elliott Wave Analysis Sep 25th 2022:

The ETF is favoured to be correcting the cycle against March 2020 low in Double three structure (WXY). After breaking below June 2022 lows, the ETF has confirmed that the next leg lower is taking place and any bounces should find sellers until we reach the next Blue Box area. The reaction lower from 08/16/2022 peak ($103.36) is incomplete and can be unfolding in 5 waves before a bounce can take place in blue (B). We expect the bounce in (B) to fail in 3 or 7 swings and continue lower to reach $73.15 – 56.27 where buyers can appear for a reaction higher in 3 waves at least or start the next leg higher. We like to buy dips in 3, 7 or 11 swings into blue boxes for a continuation to the upside as long as the March 2020 lows at $56.27 remains intact.

Source: https://elliottwave-forecast.com/stock-market/iyr-real-estate-looking-downside-whats-next/