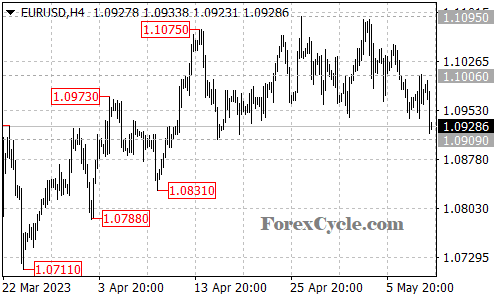

EURUSD is currently testing a key support level at 1.0909. This level is crucial for the pair as a breakdown below this level would indicate that the uptrend from the March low of 1.0515 has completed at 1.1095 already. In that case, the pair may find support at 1.0800, followed by 1.0710. On the other hand, if the support at 1.0909 holds, the price action could be treated as consolidation for the uptrend.

If the consolidation scenario plays out, the pair may move in a range between 1.0909 and 1.1095. A break of 1.1006 resistance could trigger another rise towards 1.1095 resistance, above which the pair could aim for 1.1200. However, if the support at 1.0909 breaks, it may indicate that the upside movement has already completed, and the pair could move lower towards the support levels mentioned earlier.

In summary, the EURUSD pair is currently facing a crucial support level at 1.0909, and the price action could be treated as consolidation for the uptrend as long as this level holds. A break of 1.1006 resistance could trigger another rise, while a breakdown below 1.0909 support could indicate the completion of the uptrend from the March low and trigger further downside movement. Traders should keep an eye on key economic data releases that could influence the pair’s direction in the coming days.