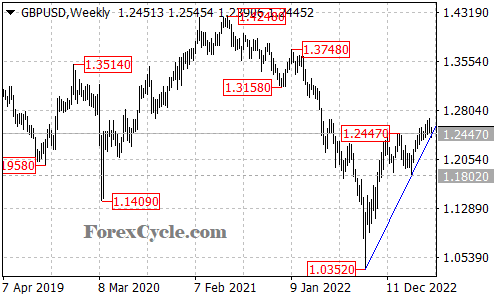

The GBPUSD currency pair is currently encountering a significant level of support as it approaches the rising trend line on the weekly chart. Traders are closely monitoring this level, as it could play a crucial role in determining the future direction of the pair.

The presence of the rising trend line suggests that the long-term uptrend from 1.0352 is still intact. As long as the trend line support holds, there is a strong possibility that the upward momentum could continue. In this scenario, traders may look for potential buying opportunities, anticipating a move towards the next target level around the 1.3200 area. This target represents a significant upside potential for the GBPUSD pair.

However, it is important to consider the alternative scenario. If the price breaks below the trend line support, it would indicate a potential shift in the market dynamics. A breakdown below this level would suggest that a lengthier consolidation phase for the uptrend is underway. Traders would then need to reassess their positions and be prepared for the possibility of another downward move. In this scenario, the pair could target the 1.1800 support level as the next potential downside objective.

In conclusion, the GBPUSD pair is currently at a critical juncture as it approaches the support of the rising trend line on the weekly chart. If the trend line support holds, the long-term uptrend from 1.0352 is likely to continue, with a potential target around the 1.3200 area. Conversely, a breakdown below the trend line support would suggest a shift in market dynamics and potentially lead to a fall towards 1.1800. Traders should carefully monitor price action and be prepared to adapt their strategies based on the outcome.