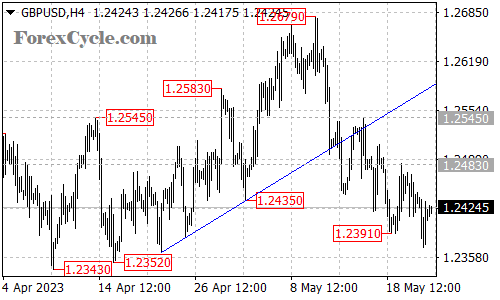

The GBPUSD pair has witnessed a significant development as it broke below the crucial support level at 1.2391, indicating a resumption of the downside movement from 1.2679. This breakdown has altered the near-term outlook for the pair, suggesting further declines may be in store.

With the breach of 1.2391, market participants can anticipate a continuation of the bearish momentum, potentially driving the price towards the next target at the 1.2280 area. This level will be closely watched by traders as it represents a significant support zone. A decisive move below 1.2280 could open the door for additional downside potential.

In terms of immediate resistance, the pair will encounter a barrier at 1.2483. A break above this level would bring the price back into focus towards the key resistance at 1.2545. Traders should monitor the price action around these resistance levels, as a breakout above 1.2545 could potentially signal a completion of the ongoing downtrend. Such a scenario would require further confirmation before shifting the overall market sentiment.

To summarize, GBPUSD has broken below the key support level at 1.2391, indicating a resumption of the downtrend from 1.2679. Further declines towards the 1.2280 area could be expected. Immediate resistance is observed at 1.2483, with the key resistance level at 1.2545. Traders should closely monitor price action and consider various factors while managing risk in the GBPUSD market.