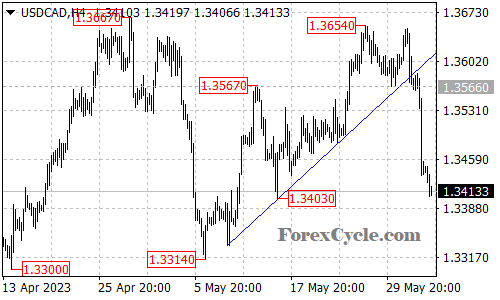

The USDCAD currency pair has experienced a continued decline, with the fall from 1.3654 extending to as low as 1.3406. This downward momentum suggests further downside potential in the near term, with the next target likely to be the 1.3300 support level.

Traders and investors are closely monitoring the price action in anticipation of additional bearish movement. The breach of key support levels indicates a shift in market sentiment, favoring the bears. As the pair heads towards the 1.3300 support, market participants will be assessing the strength of the selling pressure and the potential for a further breakdown.

It is worth noting that near-term resistance now lies at 1.3460. A break above this level would suggest a potential relief rally, bringing the price back towards the 1.3570 resistance. Such a move could indicate a temporary halt to the bearish momentum and provide an opportunity for countertrend traders.

However, given the prevailing downtrend, traders will primarily focus on the downside potential. A decisive breakdown below the 1.3300 support would indicate a continuation of the downward move, potentially leading to further losses. The next significant support levels to watch would be around 1.3200 and 1.3100.