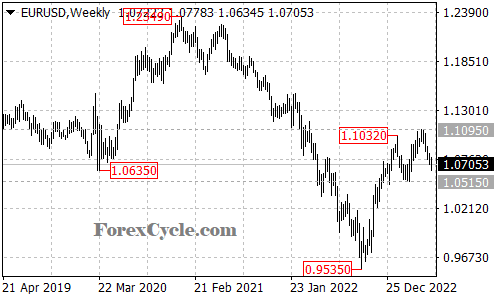

The EURUSD currency pair has been trading within a relatively tight range, fluctuating between 1.0515 support and 1.1095 resistance. This price action suggests a period of consolidation for the pair, following the significant uptrend from 0.9535.

Traders are closely monitoring the range-bound movement, awaiting a potential breakout that could signal the resumption of the bullish trend. As long as the 1.0515 support level holds, market participants expect the upside move to resume, with a breakout above the 1.1095 resistance serving as a critical catalyst.

A successful breach of the 1.1095 resistance would likely pave the way for further gains, with the next target being the 1.1400 area, followed by the 1.1800 area. Bulls would find renewed confidence in such a scenario, anticipating an extension of the previous uptrend and potentially seeking buying opportunities.

However, it is essential to consider the downside risks as well. A breakdown below the 1.0515 support level would indicate a potential completion of the uptrend at 1.1095. Such a development could trigger a deeper decline, with the pair potentially targeting the 1.0200 area.

To gain additional insights and validate potential breakout or breakdown scenarios, traders often turn to technical analysis. This approach involves examining key chart patterns, trend lines, and technical indicators. These tools can help identify potential entry and exit points, as well as provide confirmation of the prevailing trend or reversal signals.