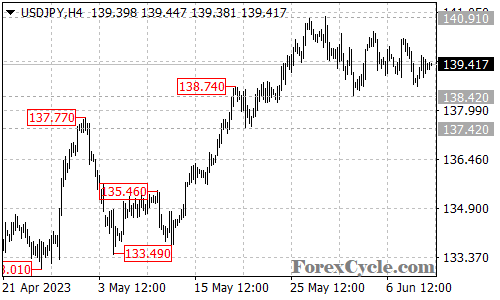

The USDJPY currency pair has been engaged in a period of sideways movement, maintaining a trading range between 138.42 and 140.91. This consolidation phase suggests a temporary pause in the market before the next directional move.

As long as the support level at 138.42 remains intact, the price action within the range can be viewed as a consolidation pattern for the uptrend that originated from 133.49. Traders should monitor this support level closely as a breakdown below it would indicate a potential completion of the upside move from 133.49. In such a scenario, the pair could experience a downward movement, potentially targeting the 135.00 support area.

On the other hand, a breakout above the resistance level at 140.91 would confirm the continuation of the uptrend and signal further upside potential. Should the price surpass this resistance level, it could trigger an additional upward move towards the 142.00 area.

Traders should exercise caution during this consolidation phase, as it presents an environment of limited price action. It is advisable to wait for a clear breakout beyond the established trading range before considering new positions. By waiting for confirmation of the market’s direction, traders can avoid potential false signals and improve their trading accuracy.

In summary, the USDJPY pair remains within a trading range between 138.42 and 140.91, indicating a period of consolidation. Traders should monitor the support and resistance levels closely for potential breakout signals. A breakout above 140.91 would suggest further upside potential towards 142.00, while a breakdown below 138.42 could lead to a downward move towards 135.00. It is advisable to exercise caution and wait for confirmation before entering new positions.