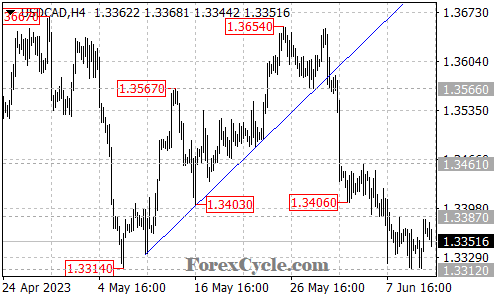

The USDCAD currency pair has been trading in a sideways manner, confined within a trading range between 1.3312 and 1.3387. This consolidation phase suggests a period of indecision and balance between buyers and sellers in the market.

Currently, there is a possibility of another downward move towards the support level at 1.3300. A breakdown below this support level could potentially lead to a further decline, with the next support target located at 1.3260. Traders should closely monitor the price action around these levels to assess the strength of selling pressure.

On the other hand, if the price manages to break above the near-term resistance at 1.3387, it could signal a potential upside breakout. Such a breakout would indicate that the downside movement from the previous high at 1.3654 has completed at the recent low of 1.3312. In this case, the price may have the potential to rise towards the 1.3461 resistance level. A further rally beyond this level could potentially lead to a retest of the previous high at 1.3654.

It is important for traders to exercise caution and wait for confirmation before taking any trading positions. A breakout or breakdown should be accompanied by strong volume and supported by other technical indicators to increase the reliability of the move.

To summarize, the USDCAD currency pair has been consolidating within a trading range between 1.3312 and 1.3387. A potential move towards the 1.3300 support level is possible, and a breakdown below this level could lead to further downside movement. Alternatively, a breakout above the 1.3387 resistance level could signal an upside breakout, potentially targeting the 1.3461 resistance level and beyond. Traders should exercise caution, wait for confirmation, and consider both technical and fundamental factors before making trading decisions.