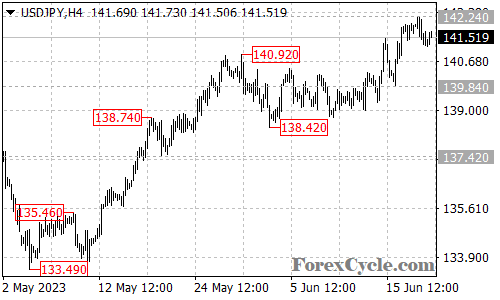

The USDJPY currency pair has been maintaining an uptrend from the 138.42 level, with a recent pullback observed from the high of 142.24. This retracement is likely a period of consolidation within the ongoing uptrend.

In the current scenario, as long as the 140.92 support level remains intact, the upside move is expected to resume. Traders should monitor the price action around this level for potential buying opportunities. A breakout above the 142.24 resistance could trigger a further upside move towards the next target at 145.00, a level of interest for traders to consider.

On the downside, a breakdown below the 140.92 support level could lead to a retracement towards the next support at 139.84, followed by the key level of 138.42. These levels should be closely monitored for potential reversals or increased selling pressure.

In summary, USDJPY is currently experiencing a consolidation phase within the overall uptrend from 138.42. The pullback from 142.24 is considered a period of consolidation. As long as the 140.92 support level remains intact, the upside move is expected to resume, with a potential breakout above 142.24 targeting the next resistance at 145.00. Conversely, a breakdown below 140.92 could lead to a retracement towards the 139.84 support, followed by the key level at 138.42. Traders should closely monitor price action and key levels for potential trading opportunities while considering both technical and fundamental factors.