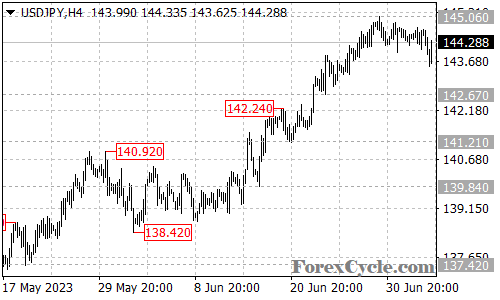

USDJPY has entered a consolidation phase after its recent uptrend from 138.42. The currency pair is currently range-bound between the support level at 142.67 and the resistance level at 145.06. This period of consolidation suggests a temporary pause in the upward momentum, with traders and investors closely monitoring price action for potential breakout opportunities.

In the coming days, range trading between 142.67 and 145.06 is anticipated. The market is in a state of equilibrium as buyers and sellers evaluate their positions and await further catalysts to drive the next directional move. This range-bound behavior provides an opportunity for traders to reassess their strategies and determine appropriate entry and exit points.

It is important to note that as long as the support level at 142.67 holds, the bias remains tilted to the upside. This suggests that once the consolidation phase concludes, the uptrend could resume. Traders should closely monitor price action near the support level for signs of a potential breakout.

A break above the resistance level at 145.06 would be a significant development, indicating renewed buying interest and potentially triggering further upside momentum. In such a scenario, the next targets for USDJPY would be at 146.40, followed by 149.00.

In conclusion, USDJPY is currently consolidating within a range between 142.67 and 145.06. Traders should remain patient and await a breakout from this range to establish new positions. A break above 145.06 could lead to further upside momentum, while a breakdown below 142.67 may indicate a potential reversal. Stay vigilant and adapt your strategies accordingly to navigate the evolving market conditions.