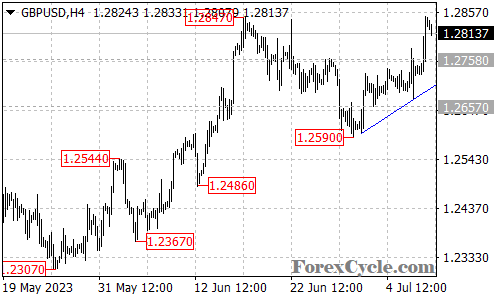

The GBPUSD currency pair has been making notable strides in recent sessions and is now approaching a critical resistance level at 1.2847. Traders are closely monitoring this level, as a break above it could potentially trigger a further upside move towards the next target at 1.2950. The pair’s upward momentum has been supported by positive market sentiment and a generally weaker US dollar.

Immediate support for GBPUSD is seen at 1.2770, and traders will be keeping a close eye on this level. A breakdown below 1.2770 could prompt a retracement in price towards the rising trend line on the 4-hour chart. This trend line has provided support for the recent bullish moves and could act as a significant level to watch for potential buying opportunities.

It’s worth noting that a break below the trend line support might indicate a shift in market sentiment and a potential return towards the 1.2590 previous low. However, as long as the price remains above the trend line support, the bullish bias is likely to remain intact.

In summary, the GBPUSD currency pair is approaching a critical resistance level at 1.2847, and a break above this level could pave the way for further upside towards 1.2950. Immediate support is seen at 1.2770, and a breakdown below this level could lead to a retracement towards the rising trend line on the 4-hour chart. Traders should stay informed, monitor key market drivers, and implement sound risk management techniques to navigate the GBPUSD market effectively.