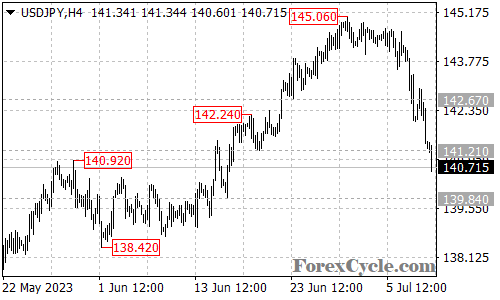

The USDJPY currency pair has sustained its downward movement, extending the decline from 145.06 to as low as 140.60. Traders are anticipating further downside potential in the coming sessions, with the next target projected at 139.84, followed by the previous low at 138.42.

The pair has encountered strong selling pressure, driving the price lower and indicating a prevailing bearish sentiment. As the downward momentum persists, market participants are closely monitoring key support levels for potential rebounds or further weakness.

Currently, resistance is forming near 141.70, and it is an important level to watch for any signs of a reversal. A successful break above this resistance could suggest a potential shift in the prevailing downtrend, opening the door for a corrective rally. However, until such a breakout occurs, the bearish outlook remains intact.

On the downside, the pair is approaching the target level of 139.84, which represents a significant support zone. A breach of this support would signal further weakness and potentially expose the previous low at 138.42. Traders should closely monitor the price action around these support levels for potential bounce-backs or further downside continuation.

In summary, USDJPY continues its downward trajectory, with the next target at 139.84 and potential further decline towards 138.42. Resistance at 141.70 should be closely monitored for any signs of a trend reversal. Traders should exercise caution, stay informed of market developments, and employ appropriate risk management strategies to navigate the currency pair’s movement effectively.