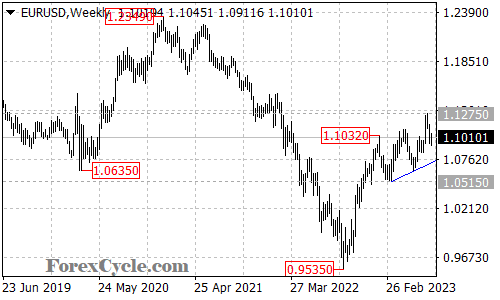

EURUSD is in a long-term uptrend from 0.9535, and the price action from 1.1032 can be seen as a consolidation phase within this uptrend.

The rising trend line on the weekly chart is a key support level to monitor. As long as this trend line support holds, there is an expectation for the upside move to resume.

A break above the resistance at 1.1275 could potentially trigger a further upside move towards 1.1500, followed by 1.1700.

On the downside, a breakdown below the trend line support would suggest that the upside move has completed at 1.1275. In such a scenario, the pair may find support at 1.0515, followed by 1.0200.

Traders should carefully watch the price’s behavior around the trend line support and key resistance levels for potential breakout or reversal signals.

In summary, the analysis suggests that EURUSD is in a long-term uptrend, with respect to the rising trend line support. A break above the resistance at 1.1275 could lead to further gains, while a breakdown below the trend line support may signal a potential reversal. Traders should pay close attention to key levels and monitor price action for potential trading opportunities.