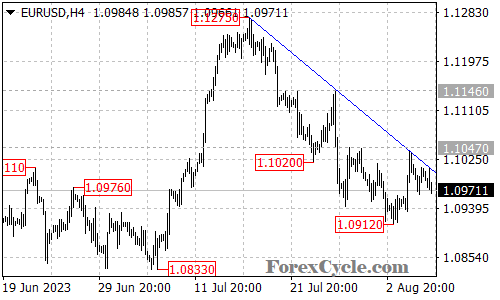

EURUSD failed to break above the falling trend line on the 4-hour chart and has been trading sideways in a range between 1.0912 and 1.1047.

As long as the price remains below the trend line, the sideways movement should be considered as consolidation within the overall downtrend from 1.1275. In this scenario, a breakdown below the support level at 1.0912 could potentially trigger a further downside move towards the 1.0833 support level.

On the upside, a breakout above the trend line resistance would indicate strength and potentially bring the price back to test the 1.1047 resistance level. Only a decisive breakout above this resistance could trigger another rise towards 1.1275.

Traders should closely monitor the price action around the falling trend line and the key support and resistance levels mentioned for potential breakout or reversal signals.

To summarize, the analysis suggests that EURUSD’s current sideways movement can be viewed as consolidation within the downtrend. The price’s behavior around the trend line and key levels will be crucial in determining further directional bias. Traders should stay attentive and adapt their strategies accordingly.