Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Euro Stoxx (SX5E) published in members area of the website. As our members know Euro Stoxx has recently made recovery against the 4593.6 peak that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from the lows and completed correction. We are getting nice decline as expected. In further text we’re going to explain the Elliott Wave pattern.

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

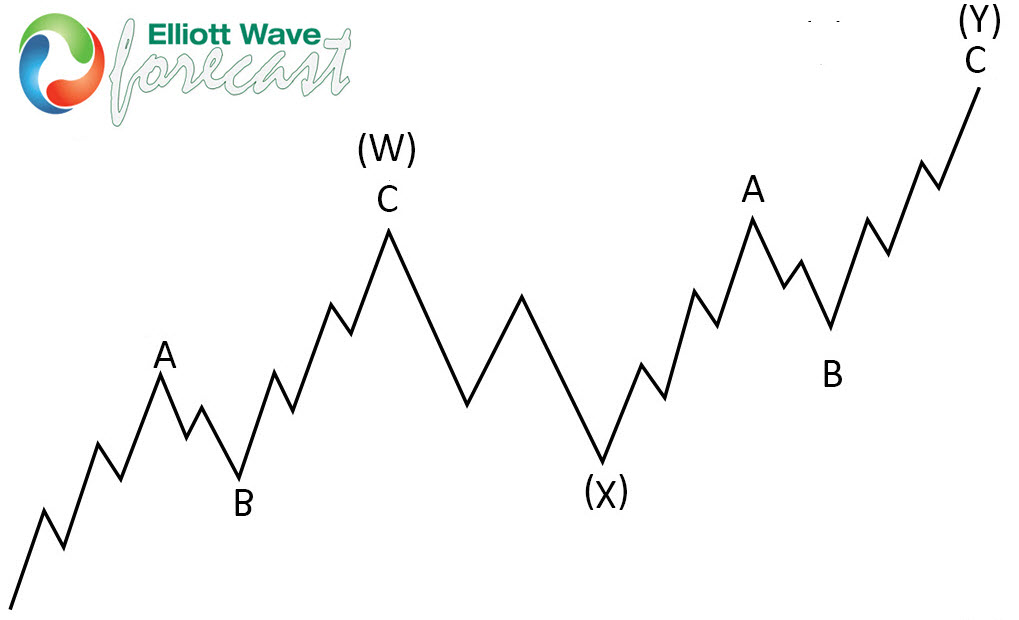

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

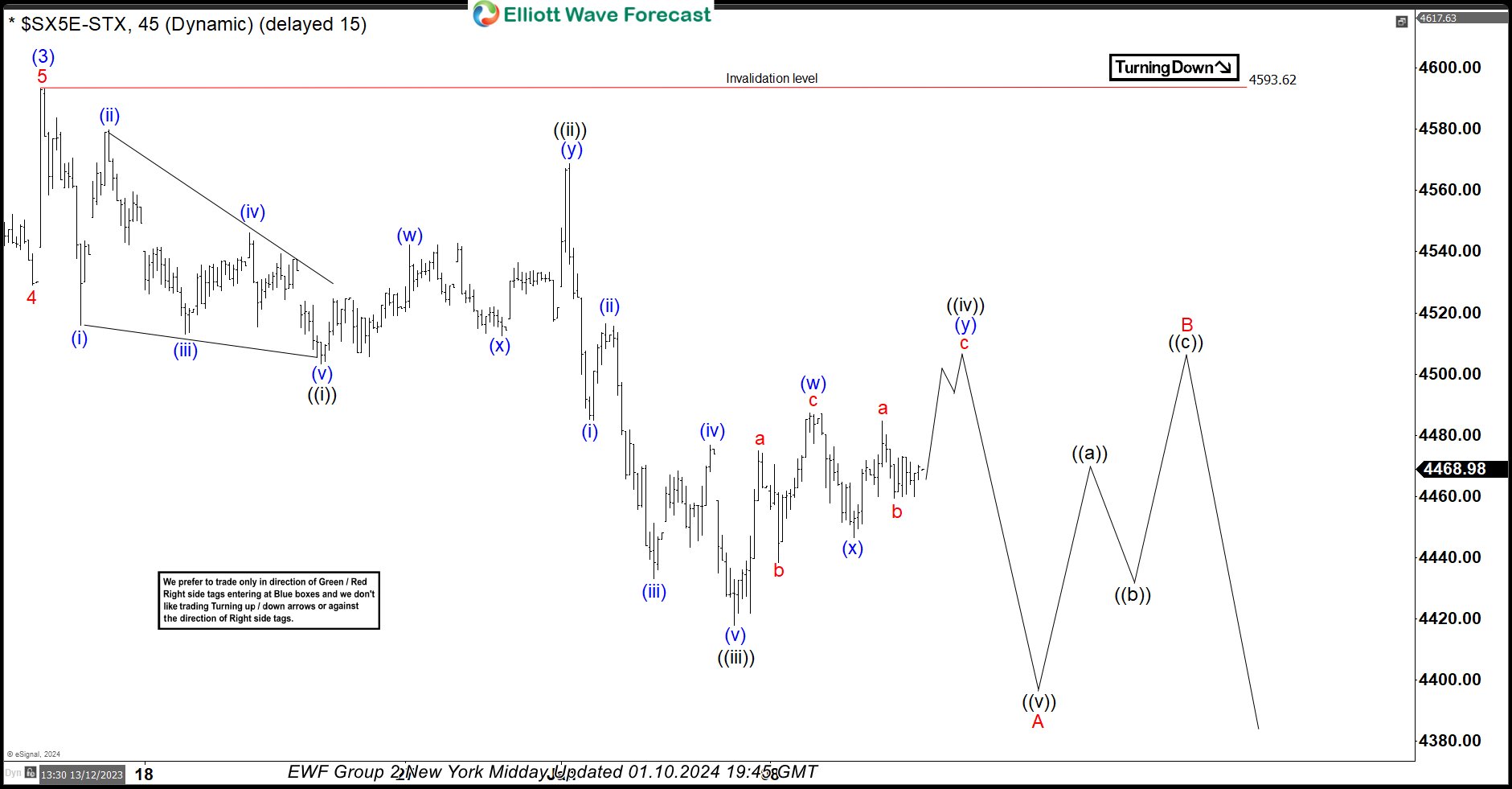

Euro Stoxx 1 Hour Elliott Wave Analysis 01.10.2024

Current view suggests Euro Stoxx is trading within the cycle from the 4593.6 high. The index is currently giving us wave ((iv)) black recovery that is unfolding as Elliott Wave Double Three Pattern. Correction has (w)(x)(y) blue inner labeling. At the moment we can count 5 swings from the low, when another leg up would be ideal to complete 7 swings pattern. We expect to see another high in wave c of (y) toward approximately 4516.6 area. Once bounce completes 7 swing structure from the lows, we should ideally see another leg down.

You can learn more about Elliott Wave Double Three Patterns at our Free Elliott Wave Educational Web Page.

Euro Stoxx 1 Hour Elliott Wave Analysis 01.16.2024

Euro Stoxx index made proposed leg up and complete 7 swings structure. It missed to reach proposed target at 4516.6 area and completed early at 4510 high. The index found sellers as expected and made break toward new lows. Euro Stoxx should ideally remain bearish in near term as far as pivot at 4510 high holds.

Keep in mind not every chart is trading recommendation. You can check most recent charts and new trading setups in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Soiurce: https://elliottwave-forecast.com/elliottwave/euro-stoxx-sx5e-elliott-wave-double-three-pattern/