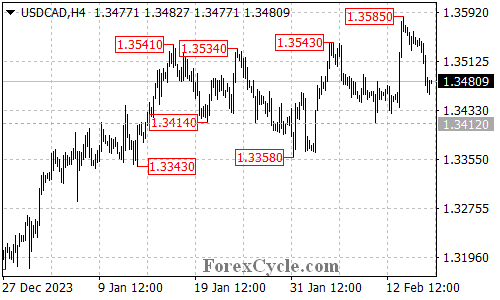

USDCAD’s recent surge above 1.3543 resistance was short-lived, as the pair has pulled back and broken below 1.3510 support. Let’s analyze the technicals to understand what this means for the pair’s near-term direction.

Range Trading or Downtrend?

- Broken Support: The decline below 1.3510 suggests a potential shift from the uptrend that began at 1.3176. This could indicate the start of range trading between 1.3358 and 1.3585.

- Further Downside Possible: If the selling pressure persists, another fall towards the 1.3412 support level is likely in the coming days.

Key Support Levels to Watch

- 1.3412 Support: A breakdown below this level could signal a continuation of the downtrend and aim for the key support at 1.3358.

- 1.3358: Trend Reversal or Retracement? Breaching this level would significantly weaken the uptrend, potentially leading to further decline towards 1.3300 or even the previous low of 1.3176. This would suggest a completed uptrend from 1.3176.

Resistance Levels for a Potential Bounce

- 1.3520 Initial Hurdle: If the sellers lose momentum and buyers step in, overcoming the initial resistance at 1.3520 could trigger a bounce.

- 1.3585: Retest or Further Uptrend? Reclaiming this level could lead to a retest of the previous resistance at 1.3585. Surpassing this level would indicate a stronger bullish move, potentially aiming for higher resistance levels.

Overall Sentiment

The technical picture presents mixed signals for USDCAD. The breakdown below 1.3510 support suggests a potential range trading scenario or even a trend reversal. However, a break above 1.3520 could signal a bounce or even a continuation of the uptrend. Monitoring the price action around the mentioned support and resistance levels will be crucial to confirm the pair’s next move.