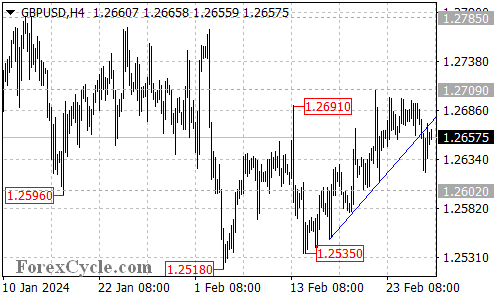

GBPUSD has displayed some conflicting technical signals recently. While it dipped below the rising trend line on the 4-hour chart, it failed to breach the crucial 1.2602 support level. This indecisiveness has resulted in sideways movement within a trading range. Let’s delve into the key support and resistance levels to understand the potential scenarios for GBPUSD.

Uptrend in Question: Can the Bulls Regroup?

- 1.2602: The Lifeline for the Uptrend: The fact that the price held above the 1.2602 support level offers some hope for the bulls. If this support holds firm, it could be interpreted as a temporary pullback within the ongoing uptrend that began at 1.2535. This scenario suggests that the upside move could resume after this consolidation phase.

Resistance Levels to Watch for Potential Rebound

- 1.2709 Resistance: A crucial test awaits GBPUSD at the 1.2709 resistance level. If the bulls can overcome this hurdle, it could signal a renewed uptrend and potentially lead to a rise towards the next resistance level at 1.2785, solidifying the uptrend.

Breakdown Scenario: Confirmation Needed for Trend Reversal

- 1.2602 Breach: A Bearish Signal: A decisive breakdown below the 1.2602 support level would be a significant development. This could confirm the completion of the uptrend from 1.2535 and potentially trigger a decline towards the 1.2518 support level, marking a possible trend reversal.

Overall Sentiment:

The technical outlook for GBPUSD is currently uncertain. The failed breakdown below support and the sideways movement create mixed signals. Holding above 1.2602 and overcoming 1.2709 resistance would favor the bulls, while a breach of 1.2602 could indicate a potential trend reversal. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.