USDJPY’s price action has shifted, raising questions about the future direction of the currency pair. This analysis examines the technical situation and explores potential scenarios.

USDJPY Breaks Key Levels:

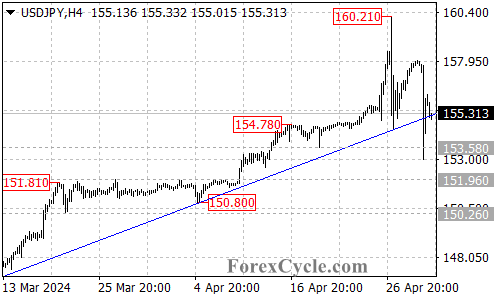

- Uptrend Faces Hurdle: A key technical development is the break below the rising trend line on the 4-hour chart and the crucial support level at 153.58. This suggests a potential completion of the upside move that began at 146.47 and reached a high of 160.21.

Potential Scenarios:

- Further Decline Likely: In the coming days, further decline is still possible with the next target zone potentially reaching the 151.50 area.

- Initial Resistance: The initial hurdle to watch on the upside is at 156.30. A break above this level could trigger a temporary upside correction towards 158.00.

- Upside Potential Limited: Even if the price surpasses 158.00, a significant rise above 159.40 is less likely in the short term due to the overall downtrend signal.

Overall Sentiment:

The technical outlook for USDJPY has turned bearish in the short term. The break below the trend line and support level suggests a potential downtrend. While a short-term bounce towards 156.30 or even 158.00 is possible, overcoming 159.40 seems unlikely in this scenario.