June Overview

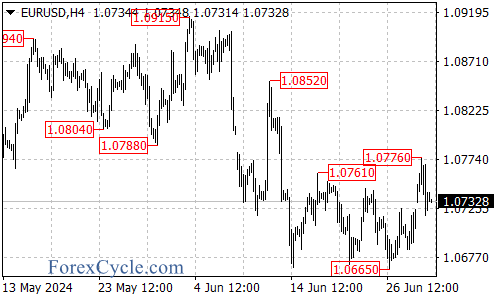

Throughout June, the EUR/USD pair experienced a downward trend, largely influenced by a strengthening US dollar. The euro briefly dipped below the 1.07 mark, closing yesterday at 1.0714.

Economic Data

The Eurozone’s manufacturing PMI for June came in at 45.6, falling short of expectations and previous figures, marking a 6-month low. Despite the economic recovery observed since Q1 2023, recent data suggests a weakening momentum and increasing economic uncertainty. France, the Eurozone’s second-largest economy, has shown poor performance, significantly contributing to the region’s economic decline.

Monetary Policy

The European Central Bank (ECB) initiated rate cuts before the Federal Reserve in its June meeting. Current predictions suggest that the ECB may implement more frequent and substantial rate cuts compared to the Fed this year. This divergence in rate cut expectations between the ECB and the Fed could potentially suppress the euro’s performance.

Technical Analysis

This week’s chart formed a doji star pattern, with daily movements fluctuating within bearish territory, indicating an overall downward trend.

Future Outlook

The euro’s trajectory will likely continue to be influenced by the relative performance of economic data from the Eurozone and the US, as well as monetary policy adjustments by their respective central banks. Key focus this week should be on PMI data from both regions.

Short-term Prediction

In the near term, the euro is expected to maintain a relatively weak and volatile trend.In conclusion, while the Eurozone economy shows signs of recovery, challenges persist. Investors and traders should closely monitor economic indicators and central bank policies for insights into the euro’s future performance.