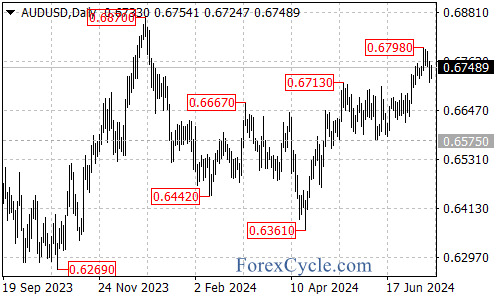

On Tuesday, July 16th, the Australian dollar (AUD) fell by 0.4% against the US dollar (USD), closing at 0.6733. Earlier in the day, the pair had dropped to a low of 0.6712. This decline was driven by a combination of factors, including a rebound in the USD, weak Q2 GDP data from China, and falling commodity prices for copper, iron ore, and oil.

Key Factors Impacting AUD/USD

- US Dollar Rebound: The USD’s continued recovery put pressure on the AUD.

- Weak Chinese GDP Data: China’s Q2 GDP data came in weaker than expected, dampening market sentiment.

- Commodity Prices: Declines in key commodities like copper, iron ore, and oil further weighed on the AUD.

Central Bank Rate Expectations

Despite these pressures, the divergence in interest rate expectations between the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed) helped limit the AUD’s downside. The market currently expects the RBA to be more cautious about rate cuts compared to the Fed.

Technical Analysis

From a technical perspective, the AUD/USD pair faced significant profit-taking after failing to break through the 0.68 resistance level. The key area to watch now is around 0.67, which previously acted as the upper boundary of a trading range.

- Support Levels: If the pair breaks below 0.67, it could fall back into its previous trading range.

- Resistance Levels: If 0.67 holds, the AUD/USD could attempt to rise again.

Conclusion

The AUD/USD pair is currently navigating a challenging environment with mixed economic signals and commodity price fluctuations. Traders should keep an eye on the 0.67 support level and the broader economic indicators to gauge the pair’s next move.