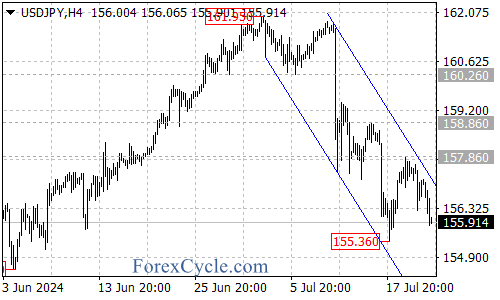

The USD/JPY pair has been exhibiting a clear downtrend pattern, as evidenced by its movement within a falling price channel on the 4-hour chart. This technical formation suggests that the pair is still in a downward trajectory from its recent high of 161.95.

Bearish Outlook

As long as the price remains confined within this channel, we can expect the downward movement to persist. Here are the key levels to watch:

- Immediate support: 155.63

- If 155.63 breaks: Watch for a move towards 154.50

- Next target: 153.90 area

Potential Bullish Scenario

While the current trend is bearish, traders should also be prepared for a potential reversal. Here’s what to look for:

- Key level: Channel resistance (upper boundary of the falling channel)

- If price breaks above the channel: Next resistance at 157.86

- Above 157.86: Watch for a push towards 158.86

Trading Strategy

- Short positions: Consider entering short positions while the price remains within the channel, with targets at 154.50 and 153.90.

- Long positions: Wait for a clear break above the channel resistance before considering long entries, with initial targets at 157.86 and 158.86.

Conclusion

The USD/JPY pair is currently showing strong bearish momentum within a falling price channel. While the downtrend remains intact, traders should stay alert for any potential breakout above the channel resistance, which could signal a shift in the short-term trend.

Remember to always use proper risk management techniques and consider multiple timeframes when making trading decisions based on this analysis.