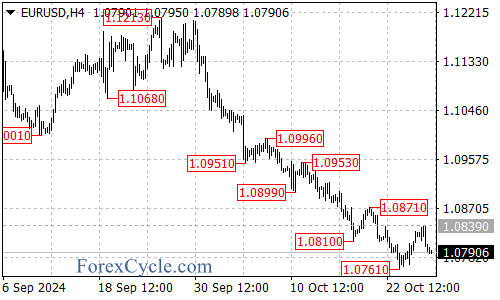

The EURUSD pair has continued its downward trajectory, extending its decline from the recent high of 1.1213 to reach a new low of 1.0761. This persistent downward pressure has caught the attention of forex traders, who are now closely monitoring key levels for potential trend continuation or reversal signals.

Currently, the critical resistance level to watch is 1.0839. As long as the price remains below this threshold, the bearish sentiment is expected to dominate, and further downside movement could be anticipated. Traders are particularly focused on the recent low of 1.0761, as a breakdown below this support could potentially trigger another leg down, with the 1.0730 area emerging as the next significant target for the bears.

However, the bulls aren’t entirely out of the game. The initial resistance at 1.0800 serves as the first hurdle for any potential recovery. A successful breakout above this level could pave the way for a test of the key resistance at 1.0839. Should the pair manage to push beyond 1.0839, it would be a significant development, possibly signaling that the downside move from 1.1213 has found its bottom at 1.0761.

In the event of such a bullish breakout, traders should be prepared for potential upside targets. The 1.0870 level would likely be the initial focus, followed by the 1.0930 area as the next significant resistance.

As the EURUSD pair navigates these critical levels, market participants will be closely monitoring price action for clues about the pair’s next significant move. The coming sessions will be crucial in determining whether the downtrend will persist or if we’ll see a potential reversal in the cards for this major currency pair.