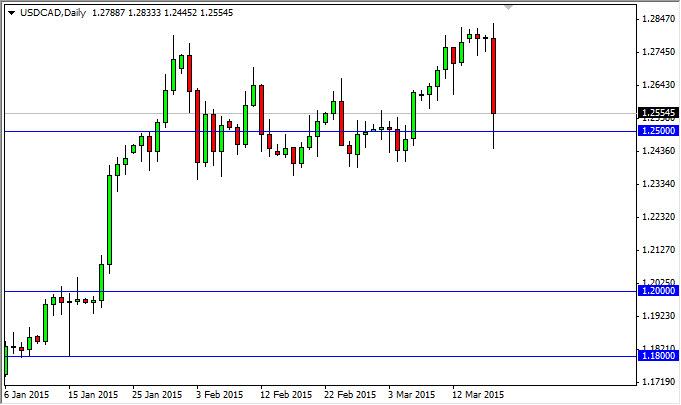

The USD/CAD pair found support at the 1.25 level, but only after smashing through it at one point. In fact, the market broke down significantly and as a result it looks like we are going to continue to see quite a bit of volatility. The Federal Reserve has slightly softened its stance, and perhaps push back any hopes of the rate increase by months, if not longer. Because of this, the US dollar will continue to suffer at the hands of other currencies, and it’s probably only a matter of time before the market price all of that potential stimulus and. With that, we feel that this pair very well could break down, and that a move below the 1.24 level could in fact send more sellers into the marketplace. You have to watch the oil markets, but what should be noticed is that the Light Sweet Crude market formed a bullish engulfing candle for the day, and that of course is a very bullish sign for oil, which could in fact be good for the Canadian dollar.

We will have to wait and see what happens today, because we did not break down, we need to see whether or not we are going to continue. Ultimately, this could be a little bit of a head fake, but at this point in time we need to see something along the lines of stability in order to start placing trades. After all, protecting your capital is the most important thing you can do as a traitor. With that, it’s almost impossible to imagine that things will be comfortable over the next day or two, and as a result we need to see the markets intend going forward.

If we do break down below the 1.24 level, we should probably head to the 1.20 level. That area is massively supportive, and extends all the way to the 1.18 level. With that, we could have a nice selling opportunity. However, somewhere in the same general vicinity if we formed a supportive candle, we would anticipate some type of bounce.