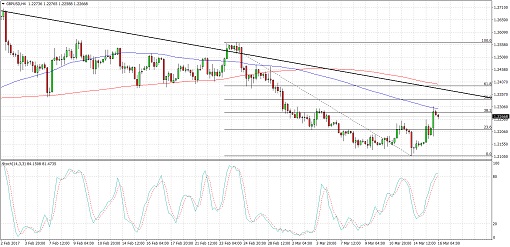

Cable recently bounced off its long-term support at the 1.2100 major psychological mark and seems to be pulling up from its recent selloff. Applying the Fib tool on the latest swing high and low shows that the 50% level lines up with the descending trend line, 100 SMA dynamic inflection point, and the 1.2350 minor psychological mark.

Meanwhile, the 61.8% Fib could also hold as resistance since it lines up with a broken support level and the 200 SMA. The 100 SMA is below the longer-term 200 SMA so the path of least resistance is to the downside.

Stochastic is on the move up but is dipping into overbought territory, which suggests that bullish pressure might be weakening. Once it crosses down and turns lower, selling momentum could return and take GBPUSD for another test of 1.2100.

UK economic data turned out stronger than expected as the claimant count showed an 11.3K reduction in joblessness versus the expected 3.2K rise. Also, the unemployment rate fell from 4.8% to 4.7% for January but the average earnings index slid from 2.6% to 2.2% versus the 2.4% forecast.

In the US, the Fed hiked interest rates as expected and their dot plot confirmed that three rate hikes are still possible for the year. Their official statement contained a few upgrades in assessment for inflation and sentiment, but dollar bulls didn’t seem so impressed by the lack of hawkishness.

It will be the BOE’s turn to announce their monetary policy decision today and no changes to interest rates or asset purchases are expected. In the US, building permits and housing starts are due, along with the Philly Fed index and initial jobless claims.

By Kate Curtis from Trader’s Way