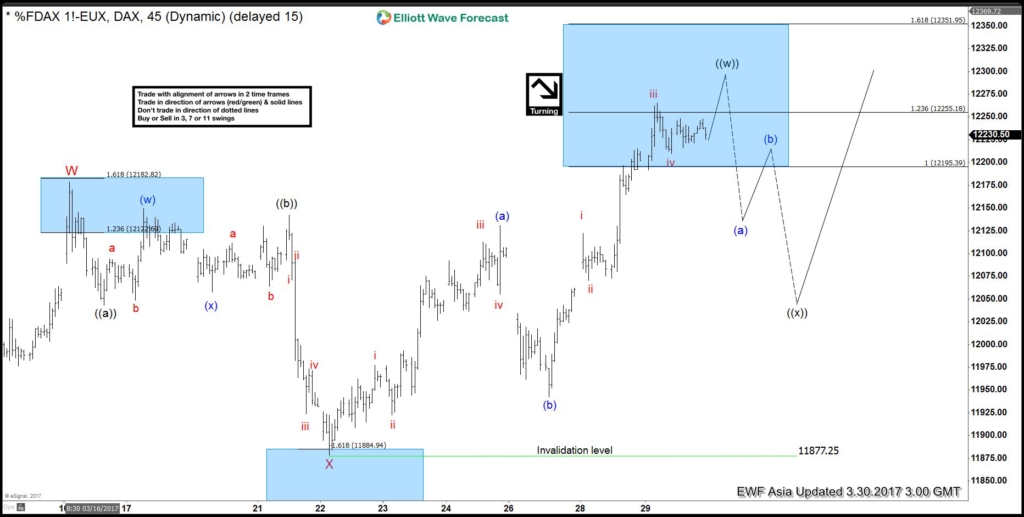

The move higher in DAX from 3/22 low is proposed to be unfolding as a zigzag Elliott Wave structure where the first leg Minutte wave ((a)) is subdivided in a 5 waves impulse Elliottwave structure and the third leg wave ((c)) is also subdivided into a 5 waves impulse Elliottwave structure. It’s not a good time to chase long in the Index at this stage as Index has reached short term inflection area where cycle from 3/22 low can end and a 3 waves pullback at minimum can be seen.

Short term view of DAX suggests move from 3/22 low is unfolding as a zigzag Elliott Wave structure where Minutte wave ( a ) ended at 12130.5, Minutte wave ( b ) ended at 11942.5, and Minutte wave ( c ) of ((w)) is expected to complete at 12255 – 12351 area, which is the 1.236 – 1.618 extension area of Minutte wave ( a ) and ( b ). Expect the Index to pullback from this area in 3, 7, or 11 swing within Minute wave ((x)) pullback before the rally resumes to a new high. Chasing long in the Index is not a good idea at this stage as pair has reached the 100% area in 3 swing.

There are two other possible scenario with DAX. Another scenario is the move from 3/22 low is unfolding as an Impulse Elliott wave structure instead of a zigzag. This scenario can happen if the current move higher gets extended to 1.618 extension (12251). In this case, we can label the move to 12130.5 as Minutte wave ( i ), the pullback to 11942.5 can be labelled as Minutte wave ( ii ) and the move higher to 12251 (at least) can be counted as Minutte wave ( iii ). In an impulse scenario, the Index should pullback in Minutte wave ( iv ) then extend higher again one more leg before finishing Minutte wave ( v ) and ending cycle from 3/22 low.

The other scenario is the more bearish one which is an Expanded Flat Elliott wave structure starting from 3/16 high. In this scenario, the move lower to 11877.25 on 3/22 low is labelled as Minute ((a)) and the current move higher in 3 waves will end Minute ((b)). If Expanded Flat is in play, then once current rally ends in Minutte wave ((b)), we can see a strong selloff in wave ((c)) which should be subdivided into 5 waves internally and could go below 11877.25.

As the Index continues to make new high, there’s little reason for us to anticipate a Flat against a bullish background. The key takeaway is

- We don’t like selling the Index as the move higher from 3/22 can get extended into an impulse structure rather than a zigzag

- Chasing long here is risky because Index has reached the 100% area in which if the move higher from 3/22 is unfolding as a zigzag, a correction in 3 waves minimum can be seen soon

Traders who intend to buy DAX therefore needs to wait for a 3 waves pullback before looking for an opportunity to join the longside.

Source : https://elliottwave-forecast.com/video-blog/dax-elliott-wave-view-short-term-top