In this Technical blog we are going to take a quick look at the past 1 hour Elliott Wave performance of AUDCAD cycle from March 20 peak (1.0332), which we presented to our clients at elliottwave-forecast.com We are going to explain the structure from that peak below

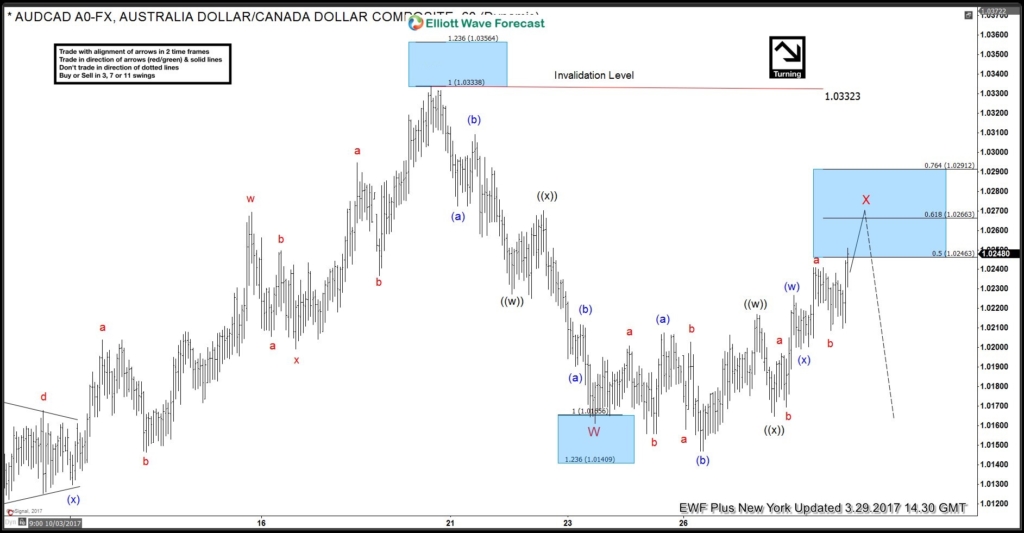

AUDCAD 3/29 1 Hour NY Updated Chart

The cycle from January 06 low has ended in the pair at March 20 peak (1.0332). The structure from the peak looks to be overlapping, hence suggesting it’s corrective structure from the peak. First leg lower ended i.e. Minor wave W at (1.0169) & Minor wave X was expected to end in 3 swings between 50-764% Fibonacci retracement area (1.0246-1.0291) followed by extension lower.

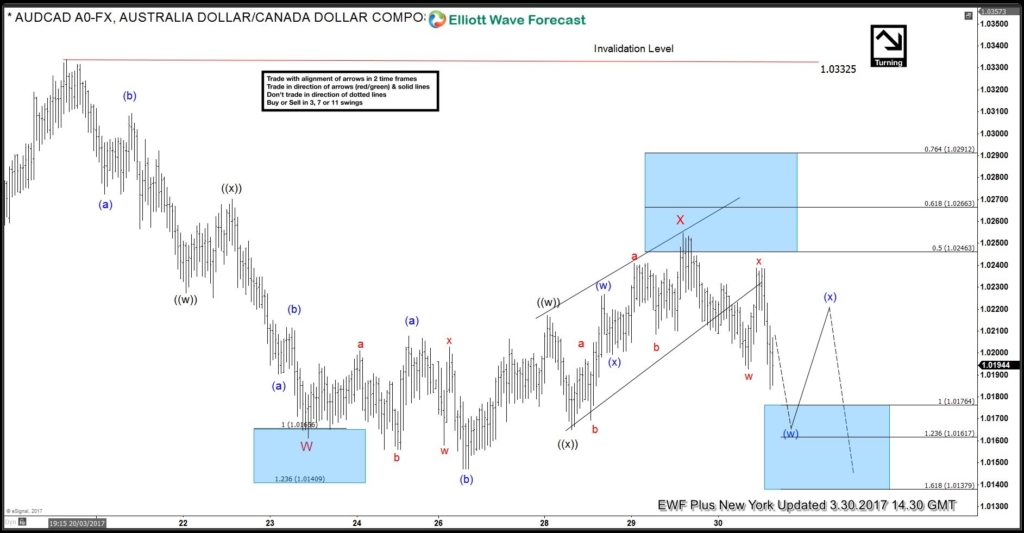

AUDCAD March 30 1 Hour NY Updated Chart

The pair found the seller’s as expected from blue box area 50-764% Fibonacci retracement area (1.0246-1.0291) & ended Minor wave X at (1.0255). While below there & most importantly as far as pivot from (1.0332) peak stayed intact, pair was expected to turn lower again initially towards 1.0176-1.0137 to see a 3 wave bounce in Minutte wave (x) against (1.0255) peak before continuation lower.

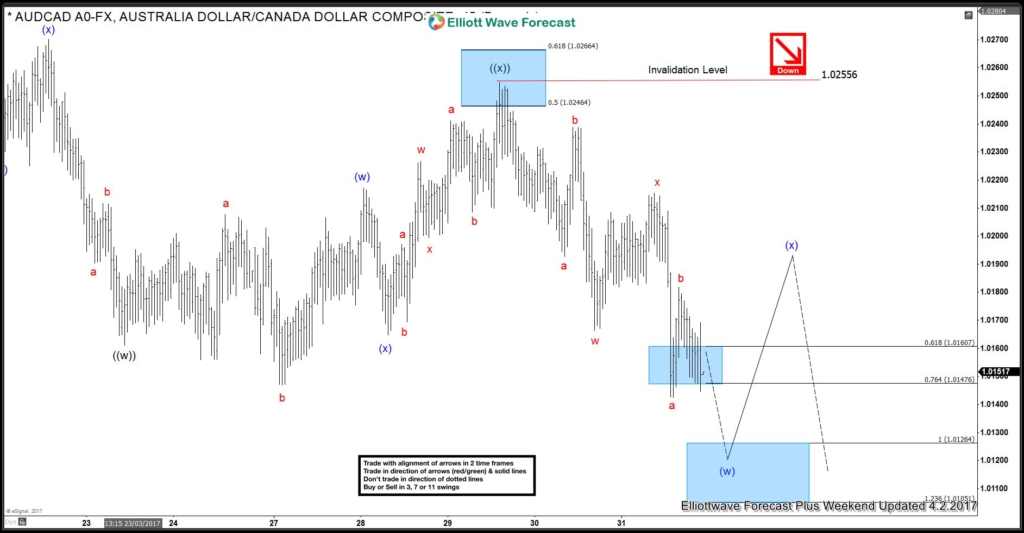

AUDCAD 1 Hour April 2, Weekend Updated Chart

The pair got the the bounce from above mentioned area & failed below the 1.0255 peak as expected. Note that, we adjusted the degree of labels but the pair keep rejecting in bounces & continues to slide lower towards 1.0126-1.0110 area lower to see a 6th swing bounce from 1.0332 peak in Minutte wave (x).

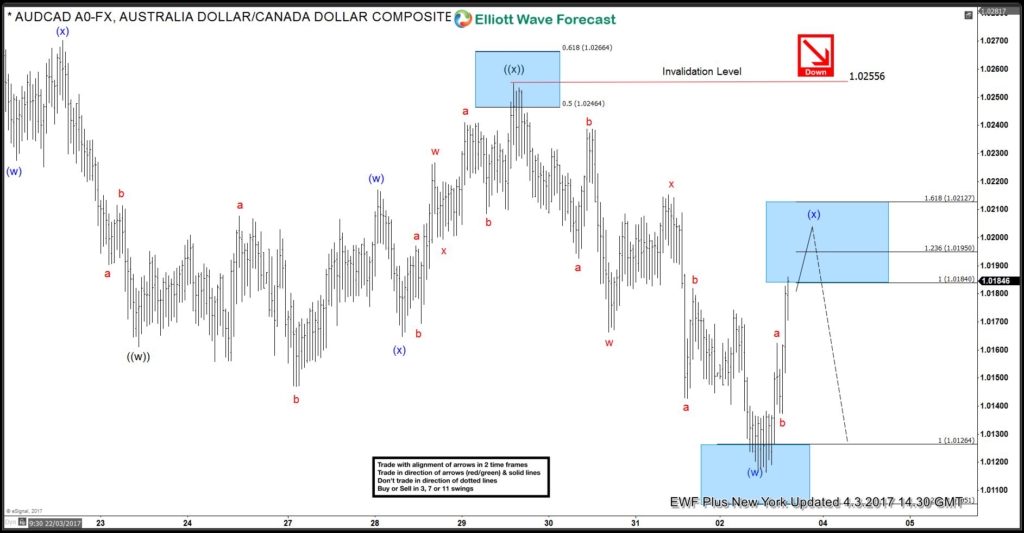

AUDCAD 1 Hour April 3, NY Updated Chart

The pair got the 3 swings bounce as expected from mentioned blue box area 1.0126-1.0110 in Minutte wave (x) & found sellers in between 1.0184-1.0212 area. Afterwards pair resumed the decline lower & while below 1.0255 peak pair should be looking for 1 more push lower towards 1.0074-1.0032 area to end 7 swings double three from 1.0332 peak before pair starts the 3 waves back.

Source : https://elliottwave-forecast.com/forex/audcad-elliott-wave-calling-decline