In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZD JPY . We’re going to take a look at the structures, count the swings and explain the trading setup.

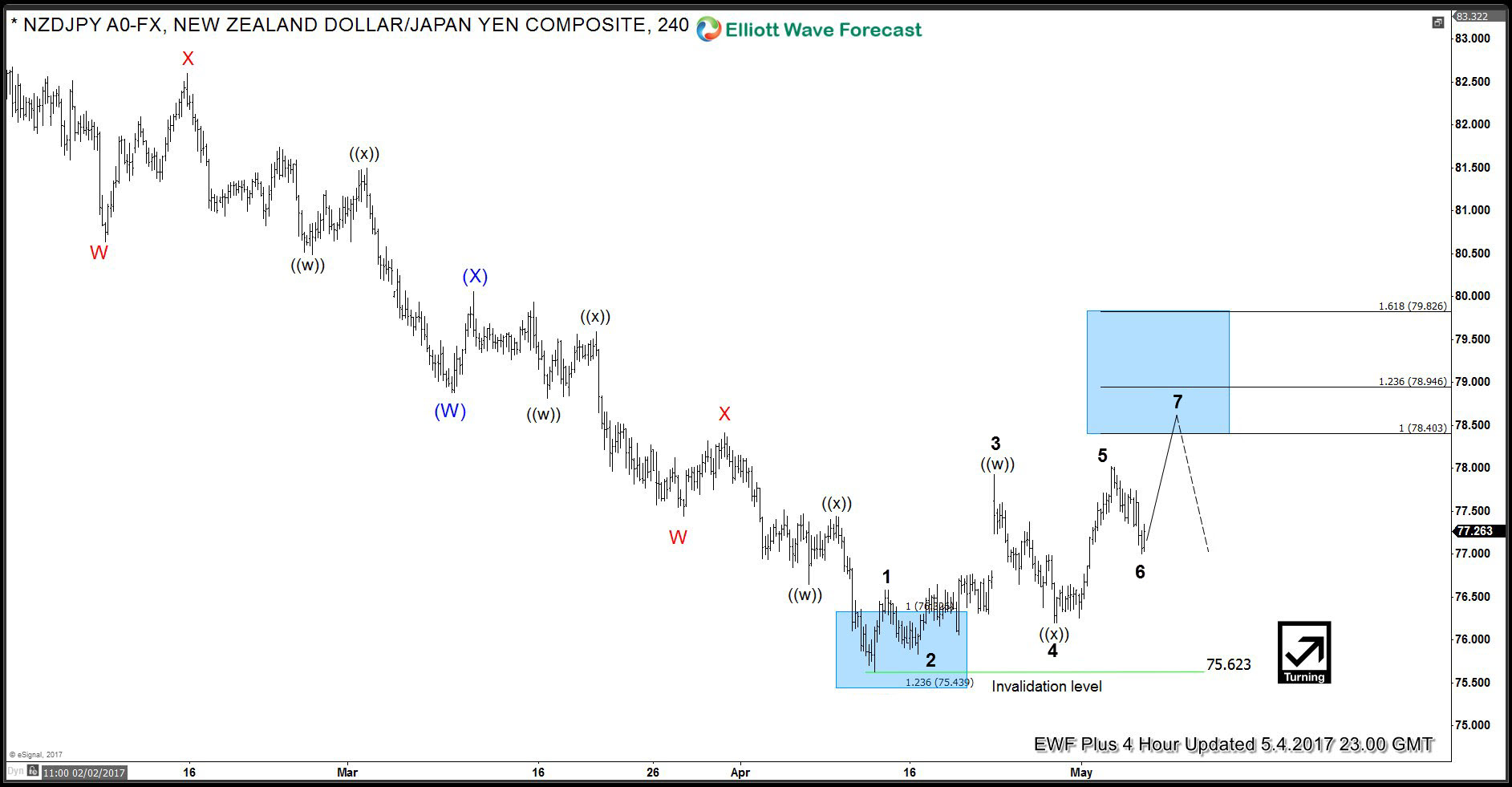

The chart below is NZD JPY 4 hour update from 05.04.2017. As our members know, we were pointing out that NZDJPY is having incomplete bullish swings sequnces from the 75.62 low. Structure has been calling for more strength in 7th swing toward 78.40-78.94 ( taking profit area). Once the pair reaches proposed area in 7 swings, we expect to see 3 wave pull back to correct the cycle from the lows.

Now let’s take a look at the short term structures…

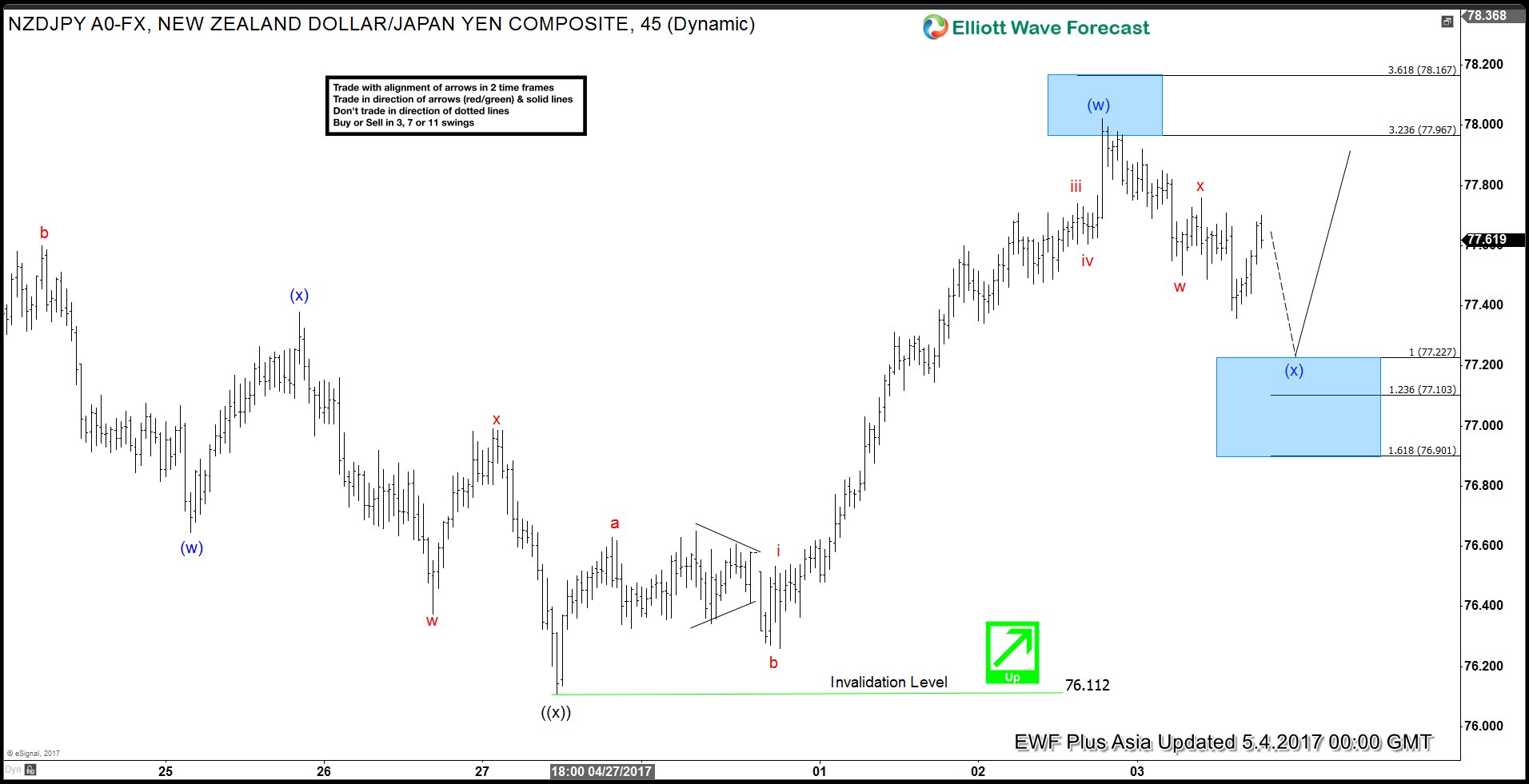

NZD JPY 1 Hour Chart 05.04.2017

The pair is bullish against the 76.112 low. Wave (x) pull back is expected to make another short term low ideally to reach 77.22-76.90 ( buying area). As we got incomplete bullish sequences in 4 hour chart, we advised our members to avoid selling the pair and keep buying dips in 3,7,11 swings. Invalidation level for the trade comes at 76.90 and we’re targeting 78.40-78.94 area.

NZD JPY 1 Hour Chart 05.09.2017

Eventually the pair has reached proposed target, giving us nice profits. As of right now, the pair has scope to extend little bit higher still toward 79.03-79.32 area before find sellers for for a 3 wave pull back at least.