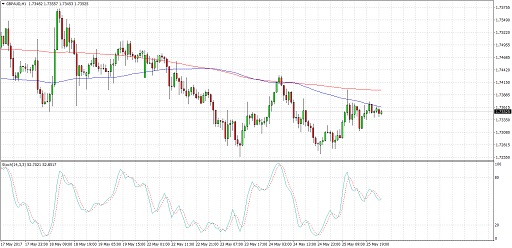

GBPAUD failed in its last two attempts to break below support around 1.7275, creating a double bottom pattern with the neckline at 1.7415. Price has yet to break past the neckline before confirming this reversal formation but if that happens, the pair could head north by an additional 140 pips or the same height as the chart pattern.

However, the 100 SMA is below the longer-term 200 SMA and seems to be holding as dynamic resistance, which indicates that the path of least resistance is to the downside. Also, stochastic is heading down to show that sellers are in control of price action at the moment.

The British pound was one of the weaker performers of the day as the UK second estimate GDP featured a downgrade from 0.3% to 0.2% instead of holding steady. This cast doubts on traders’ outlook that the UK economy could stay resilient even with Brexit going on, adding to the current list of issues already dampening the currency’s gains.

Meanwhile, the Australian dollar could be poised to benefit from a rebound in commodities after the OPEC decided to extend their output deal by another nine months. Although crude oil reacted by selling off on profit-taking, this decision could keep oversupply concerns in check and support other commodities as well.

By Kate Curtis from Trader’s Way