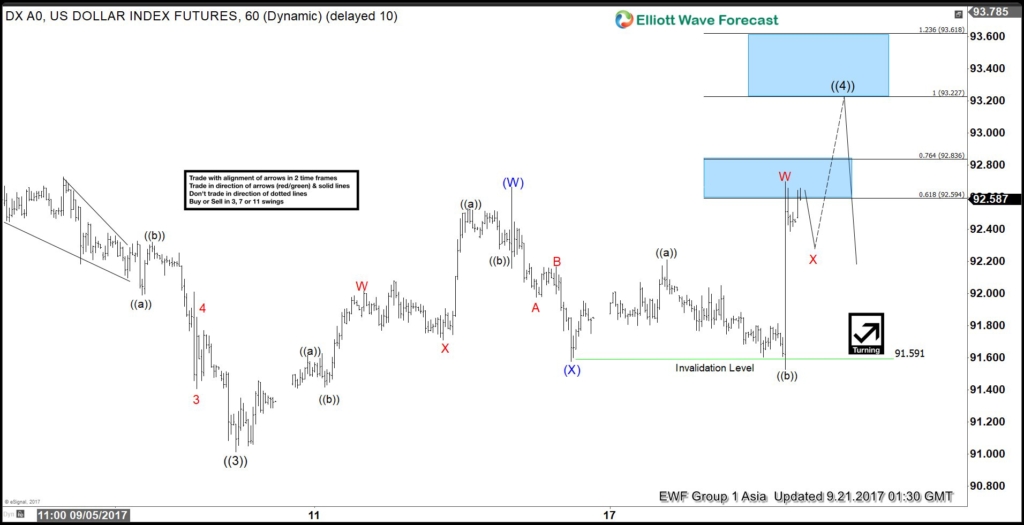

DXY Short Term Elliott Wave view suggests that the decline to 91.01 ended Primary wave ((3)). Primary wave ((4)) bounce remains in progress as a double three Elliott Wave structure. Up from 91.01, Intermediate wave (W) ended at 92.66 and Intermediate wave (X) ended at 91.591. Near term, while pullbacks stay above 91.591, expect Index to extend higher towards 93.227 – 93.618 area to complete Primary wave ((4)). Afterwards, Index should resume the decline lower or at least pullback in 3 waves. We don’t like buying the proposed bounce.

DXY 1 Hour Elliott Wave Chart

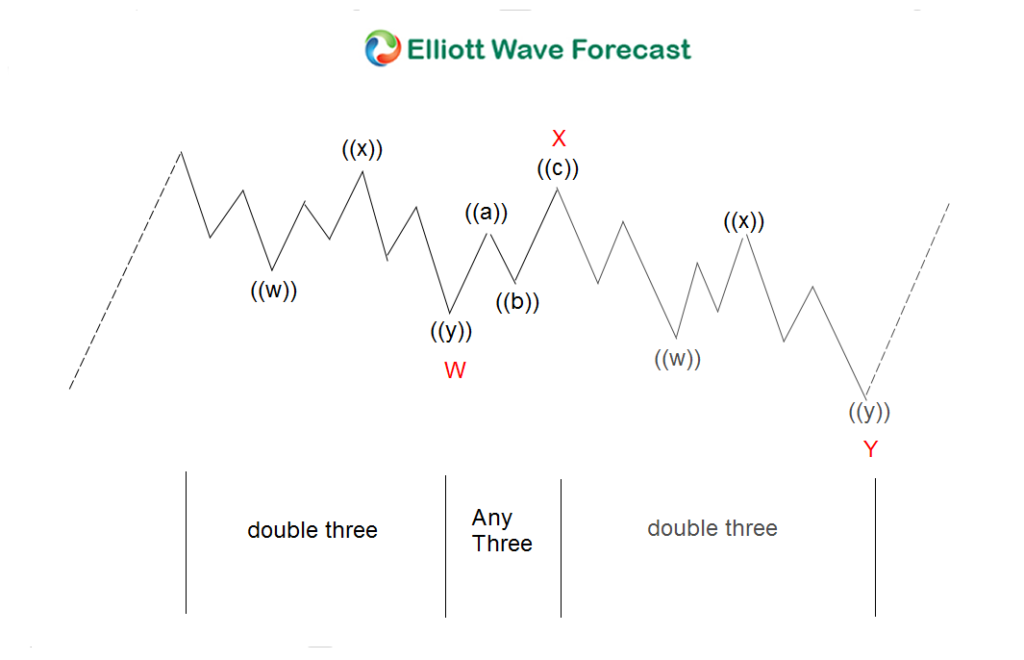

Double three ( 7 swings) is the most important pattern in Elliott wave’s new theory. It is also probably the most common pattern in the market these days. Double three is also known as a 7-swing structure. It is a very reliable pattern that gives traders a good opportunity to trade with a well-defined level of risk and target areas. The image below shows what Elliott Wave Double Three looks like. It has labels (W), (X), (Y) and an internal structure of 3-3-3. This means that all 3 legs has corrective sequences. Each (W) and (Y) is formed by 3 wave oscillations and has a structure of A, B, C or W, X, Y of smaller degrees.

Source : https://elliottwave-forecast.com/forex/dxy-elliott-wave-view-double-correction/