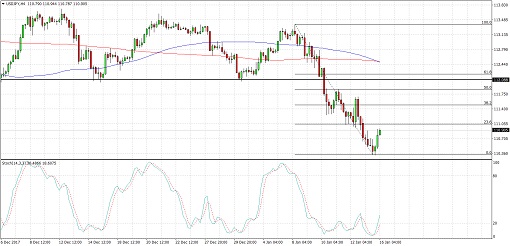

USDJPY recently fell through support at the 112.00 major psychological level and looks ready for a pullback to this area of interest. Applying the Fib tool on the latest swing high and low shows that the 61.8% level is close to this broken support, which might now hold as resistance.

Stochastic is pulling up from the oversold region to indicate a return in buying pressure. However, a shallow pullback to the 38.2% Fib might be enough to let the selloff resume.

The 100 SMA is crossing below the longer-term 200 SMA to signal that the path of least resistance is to the downside. This means that the downtrend is more likely to continue than to reverse.

The dollar has been on very weak footing despite a few upside data surprises. Banks were closed on a holiday yesterday, so the usual stock market rallies weren’t there to buoy the currency higher.

Only the Empire State manufacturing index is due today and a gain from 18.0 to 18.5 is expected. Stronger than expected results, combined with positive earnings data, could lead to a pickup for the dollar.

Still, it’s worth noting that the BOJ recently made some adjustments to its bond purchases, leading traders to speculate that tapering is in order. For now, doubts about the Fed’s pace of tightening remain owing to a weaker inflation outlook.

By Kate Curtis from Trader’s Way