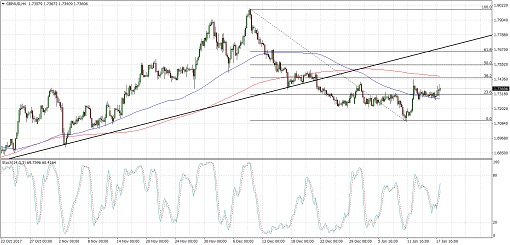

GBPAUD recently fell through the rising trend line on its 4-hour time frame, indicating that a reversal is in order. Price is showing a pullback now, and applying the Fib tool shows that the 61.8% retracement level lines up with the broken support zone.

The 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside. In other words, the selloff is more likely to resume than to reverse. Stochastic is still pointing up to signal that buyers are in control but reaching overbought levels could draw more sellers in.

Economic data from Australia turned out stronger than expected, as the employment change figure printed a 34.7K gain versus the estimated 13.2K increase. The previous reading enjoyed an upgrade from 61.6K to 63.6K.

However, the unemployment rate increased from 5.4% to 5.5% instead of holding steady. As it turned out, the participation rate rose a couple of notches from 65.5% to 65.7%.

Meanwhile, the pound is still weighed down by Brexit concerns and to some extent, the Carillion collapse. There are no major reports due from the UK today. China has a number of top-tier reports due, though, and this could influence Aussie action still.

GDP, retail sales, industrial production, and fixed asset investment are expected to tick lower and might reflect weaker global demand for commodities. Stronger than expected results, on the other hand, could be bullish for the Aussie.

By Kate Curtis from Trader’s Way