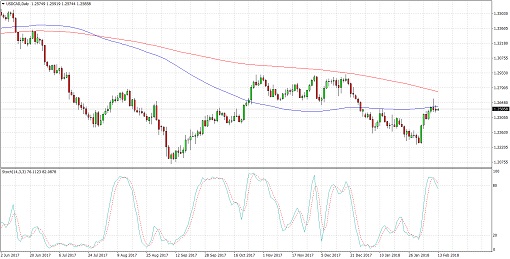

USDCAD could be in for a long-term reversal from its selloff as price has formed a double bottom on its daily time frame. The pair has yet to test the neckline around the 1.2950 minor psychological level, though.

A break higher could send price up by an additional 800 pips or roughly the same height as the chart formation. For now, the 100 SMA is below the longer-term 200 SMA to suggest that the path of least resistance is to the downside or that the selloff would continue. However, the gap between the moving averages is narrowing to indicate weakening bearish momentum.

Stochastic is turning lower from the overbought zone to show that sellers could still take over. After all, the 100 SMA is holding as dynamic resistance and the 200 SMA could serve as a ceiling also.

The US dollar has been weaker against most of its peers in recent sessions as risk appetite is returning to the financial markets. Strangely enough, the Loonie was barely able to take advantage of the rallies and the pickup in crude oil prices stemming from a record OPEC compliance.

There are no major reports from both the US and Canada today, so sentiment could still be king. A continuation of the risk-on rallies could prove positive for the higher-yielding Loonie while a return in risk aversion could lead to more gains for this pair.

Later on, the US will release its CPI and retail sales data. Headline inflation could rise by 0.3% versus the earlier 0.1% uptick while the core figure could post a 0.2% gain. Headline retail sales could see a 0.5% gain versus the earlier 0.4% increase.

By Kate Curtis from Trader’s Way