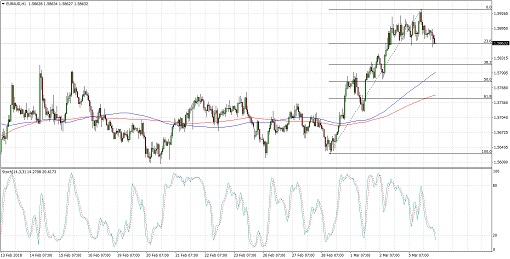

EURAUD recently broke past the 1.5800 major psychological mark to signal that more gains are in the cards. However, price is stalling around 1.5925 and might be due for a pullback to the broken resistance.

Applying the Fib tool on the latest swing low and high shows that the 50% level is close to this area of interest. Stochastic is heading south so the correction could go on, but buying pressure could soon return as the oscillator is dipping into oversold territory.

The 100 SMA is above the longer-term 200 SMA, confirming that the path of least resistance is to the upside. In other words, the rally is more likely to resume than to reverse. The 100 SMA is close to the 50% Fib while the 200 SMA is at the 61.8% Fib, adding to its strength as potential support.

Economic data from Australia has been weaker than expected today, with the current account deficit widening from 11 billion AUD to 14 billion versus the estimated 12.3 billion AUD shortfall. Retail sales also disappointed with a 0.1% uptick versus the estimated 0.4% gain.

The RBA interest rate decision is coming up next and no actual rate changes are eyed. Market watchers are likely to watch closely for any changes in rhetoric that could affect monetary policy expectations.

As for the euro, risk aversion during the London session weighed on European equities and the shared currency. Final services PMI readings were also mostly weaker than expected. Only the retail PMI is due today but traders may be positioning ahead of the ECB statement.

By Kate Curtis from Trader’s Way