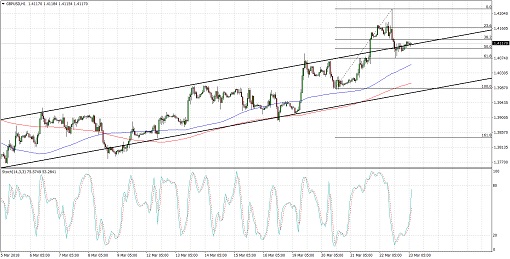

GBPUSD has been trending higher on its short-term time frames inside an ascending channel. Price has surged past the resistance to signal that a steeper climb is underway, but a pullback is currently taking place.

Applying the Fibonacci retracement tool on the latest swing low and high shows that the 50% level lines up with the top of the channel, which is now holding as support. A continuation of the climb could lead to a test of the swing high near the 1.4200 major psychological mark.

The 100 SMA is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside or that the uptrend is more likely to continue than to reverse. Stochastic is also on the move up to confirm that buyers have the upper hand.

UK retail sales came in stronger than expected with a 0.8% gain versus the projected 0.4% increase. The BOE decision was in line with expectations of no changes to interest rates or asset purchases, but the MPC minutes turned out hawkish since a couple of members voted to hike.

However, Cable gains were limited as risk-off vibes spurred a rally for the safe-haven dollar. Trump signed a memorandum to impose higher tariffs on nearly $60 billion worth of Chinese goods from companies involved in U.S. intellectual property theft.

Chinese officials have responded to the announcement by reiterating that the country won’t back down from a trade war if it happens. It also urged the U.S. government to rethink its protectionist stance, and further headlines on this issue could continue to impact market sentiment.

By Kate Curtis from Trader’s Way