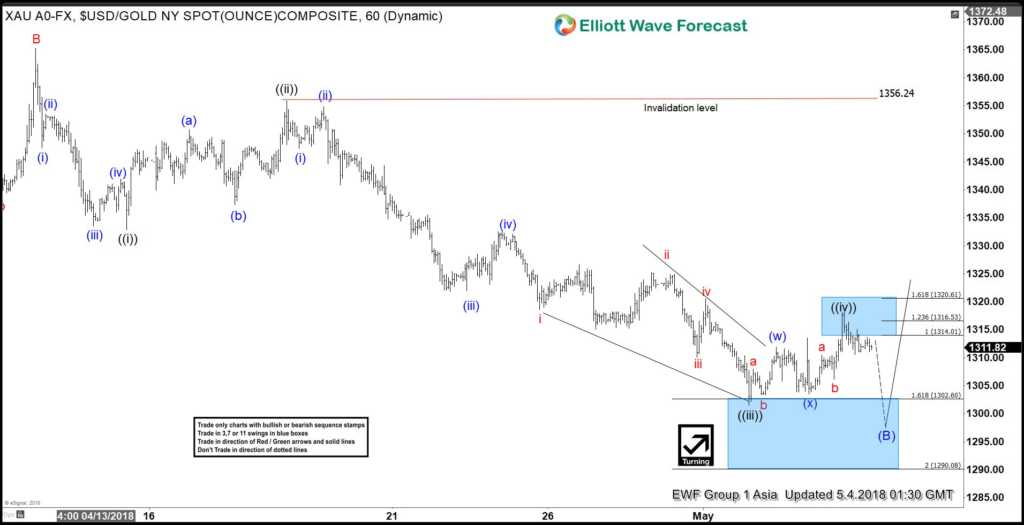

Gold short-term Elliott Wave view suggests that the rally to 4/11 high at 1365.24 ended Minor wave B. Below from there, the decline is unfolding as an impulse Elliott wave structure in Minor wave C of (B) lower. This structure forms a bigger FLAT Elliott Wave structure which starts from 1/25 peak. Internals of each leg to the downside, i.e. wave ((i)), ((iii)), and ((v)), shows a 5 waves structure subdivision in the lesser degree with extension in the third wave.

Down from 1365.24 high, Minute wave ((i)) of C ended in 5 waves at 1332.78. Minute wave ((ii)) of C ended as a Zigzag Elliott Wave structure at 1356.24. Minute wave ((iii)) of C ended in another 5 waves structure at 1301.5 low. Above from there, the bounce in Minute wave ((iv)) of C appears complete as a double three Elliott Wave structure at yesterday’s high at 1318.1. However, a break below 1301.5 low remains to be seen to confirm the next leg lower in Minute wave ((iv)) of C bounce. Until then, a double correction higher in Minute wave ((iv)) bounce can’t be ruled out.

The entire FLAT structure from 1/25 peak has reached 100% target at 1302.1, thus the cycle is mature and Intermediate (B) could end any moment. However, near-term, while bounces fail below 1318.1 high and more importantly the pivot from 1356.24 high stays intact, gold has scope to see another push lower. Potential target for Minute wave ((v)) of C, if it happens, comes at 1295.55 – 1297.92 which is the 1.236%-1.382% inverse Fibonacci extension of a Minute wave ((iv)). Afterwards, the metal is expected to resume the upside or should produce a bounce in 3 swings at least. We don’t like selling it.