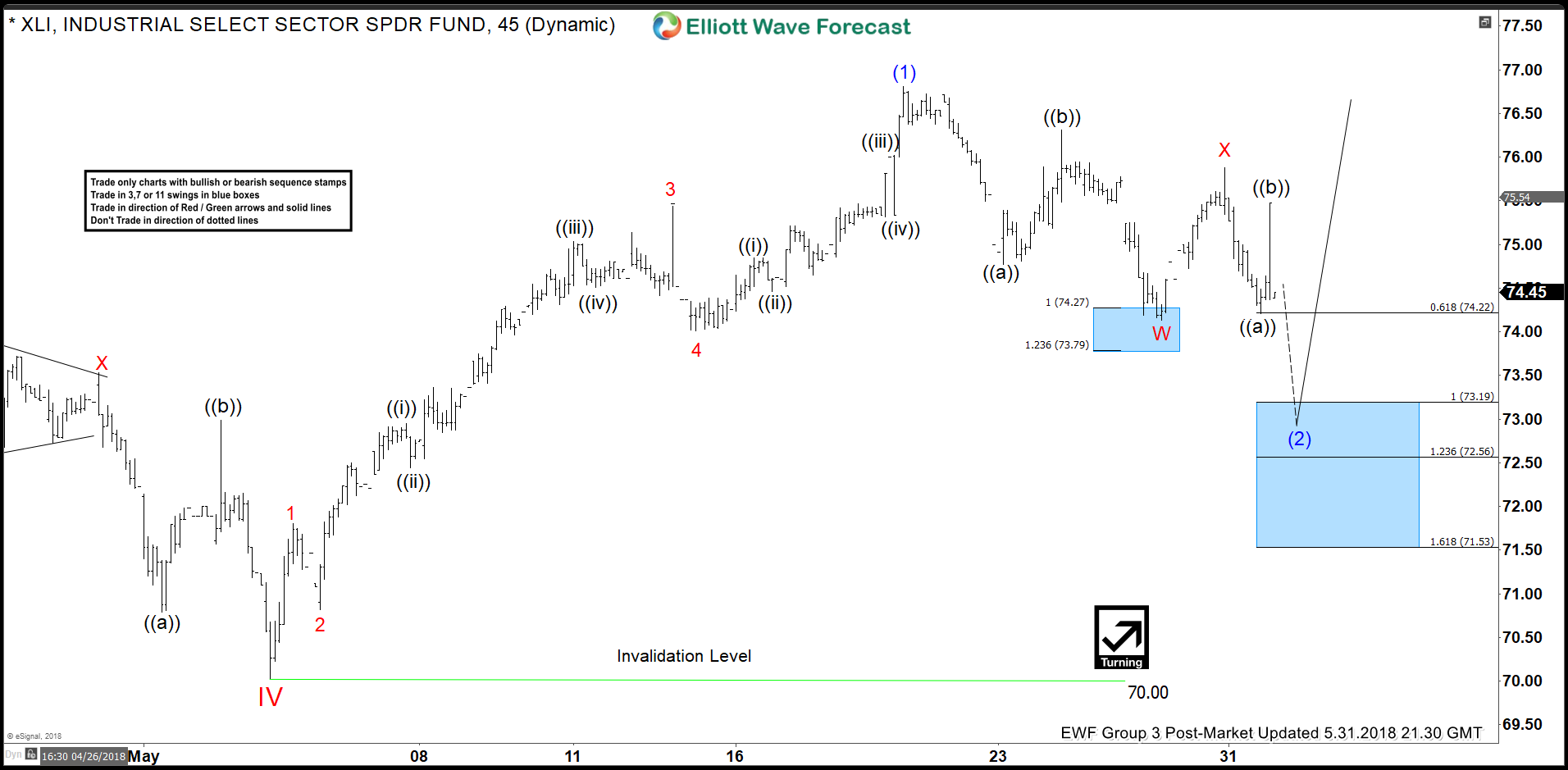

XLI: Industrial sector ETF short-term Elliott wave view suggests that the decline to 70$ on May 03 low ended cycle degree wave IV pullback. Above from there, the instrument rallied higher as an impulse and has scope to resume the cycle degree wave V higher. In an impulse structure, the subdivision of wave 1, 3, and 5 is also an impulse structure of a lesser degree. On the other hand, wave 2 & 4 are corrective in nature i.e double, triple three, Flat etc.

Down from 70$ low, the rally to 71.80$ high ended Minor wave 1 in 5 waves and pullback to 70.83$ low ended Minor wave 2 pullback. Above from there the rally to 75.12$ high ended Minor wave 3 in 5 waves structure and the pullback to 74.01$ ended Minor wave 4. A rally from there to 7.80$ high ended Minor wave 5 and also completed the intermediate wave (1) of an impulse. Below from there, the ETF is correcting the cycle from 5/03 low (70$) in 3, 7 or 11 swings.

Near-term focus remains towards 73.19$-72.56$ 100%-123.6% Fibonacci extension area of Minor W-X to end the intermediate wave (2) pullback as Elliott Wave double three. Afterwards, the ETF is expected to resume the upside ideally provided the pivot at 5/03 low (70$) stays intact or should do a 3 wave bounce at least. We don’t like selling it into a proposed pullback.

XLI 1 Hour Elliott Wave Chart

Source : https://elliottwave-forecast.com/stock-market/xli-elliott-wave-view-dips-can-remain-supported/