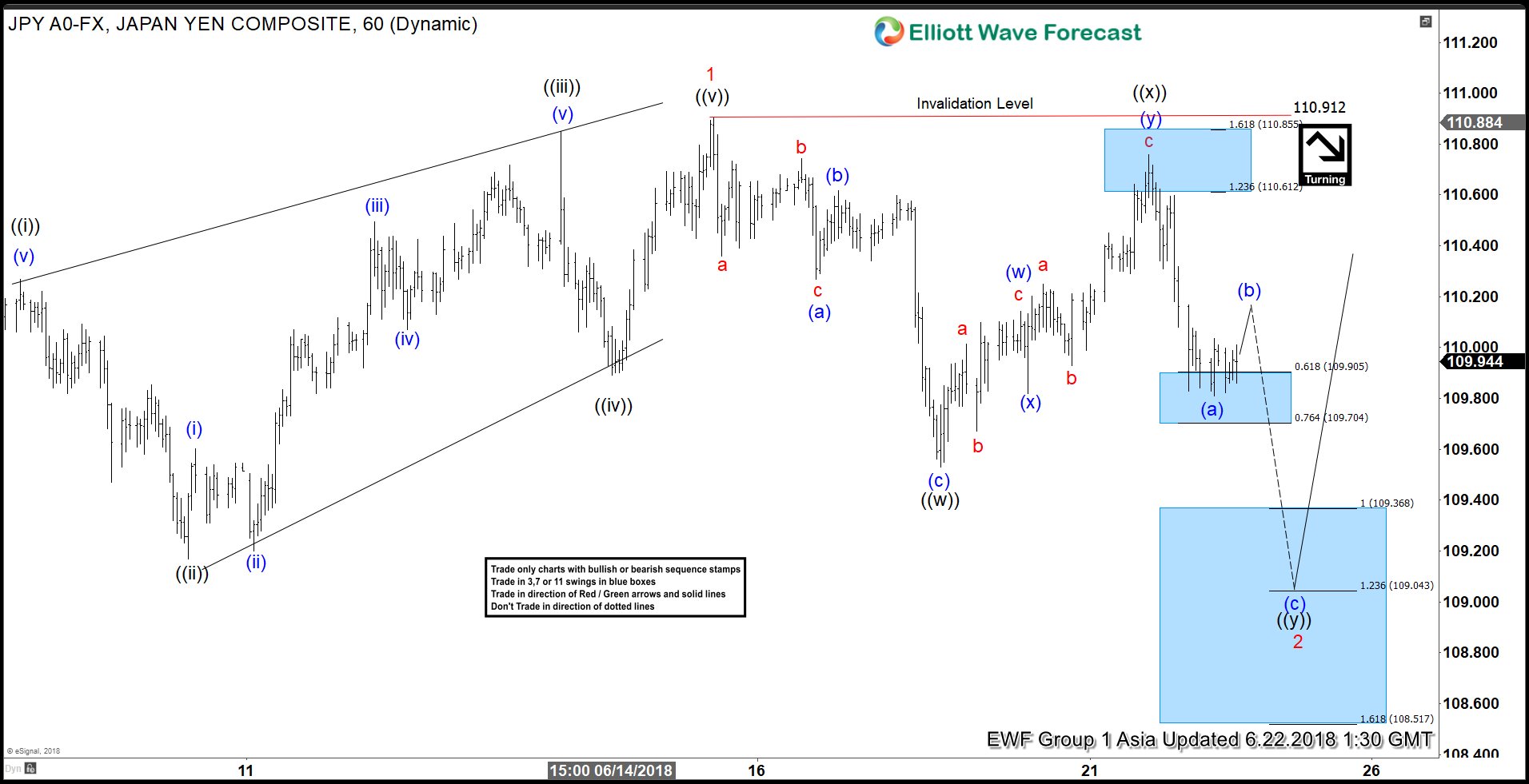

USDJPY short-term Elliott wave view suggests that the rally to 110.91 high ended Minor wave 1 & also the cycle from 5/29 low. The internals of that rally higher unfolded as Elliott wave leading diagonalwhere Minute wave ((i)) ended at 110.27 high in 5 waves, Minute wave ((ii)) pullback ended at 109.17, and Minute wave ((iii)) ended at 110.85 in 5 waves structure.

Down from there, Minute wave ((iv)) pullback ended at 109.89 and Minute wave ((v)) of 1 ended at 110.90 high in another 5 waves structure. Below from 110.9 high, pair is doing a Minor wave 2 pullback to correct cycle from 5/29 low in 3, 7 or 11 swings. So far the pullback looks to be unfolding as Elliott wave double three structure where Minute wave ((w)) ended at 109.53 with internals subdivision as zigzag correction. Up from there, Minute wave ((x)) bounce ended at 110.76 with internal subdivision of a double three. Near-term focus remains towards 109.36-109.04, which is 100%-123.6% Fibonacci extension area of Minute ((w))-((x)) to end the Minute wave ((y)) & also the Minor wave 2 pullback. Afterwards, the pair is expected to resume higher provided the pivot from 5/29 low (108.10) stays intact or should do a 3 wave bounce at least. We don’t like selling the proposed pullback.

USDJPY 1 Hour Elliott Wave Chart

Source : https://elliottwave-forecast.com/forex/elliott-wave-usdjpy-support-around-corner/