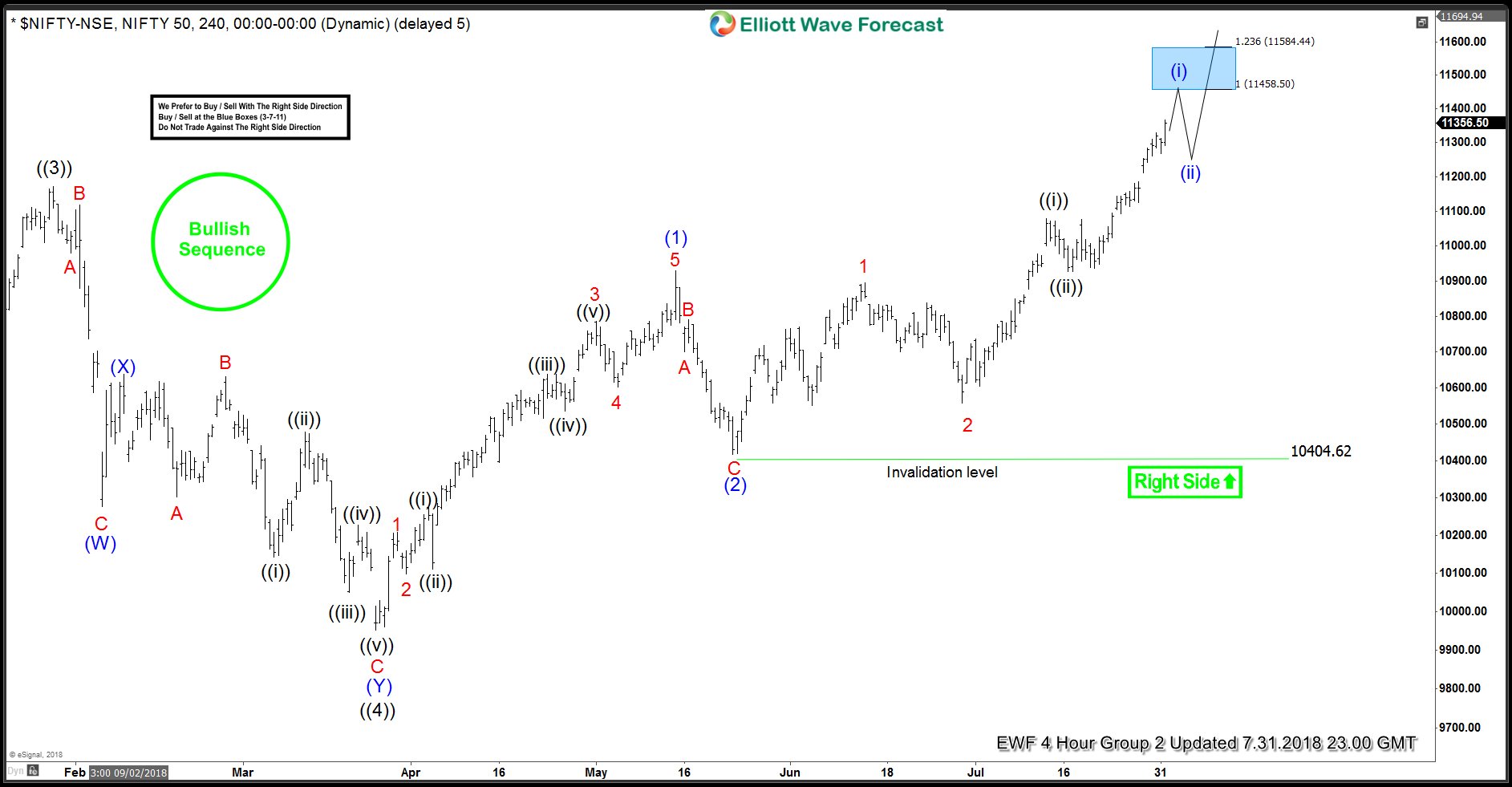

Nifty Elliott wave analysis suggests that the rally to 11171.55 high ended primary wave ((3)). Down from there, the decline to 9951.9 low ended primary wave ((4)) pullback. The internals of that pullback unfolded as Elliott wave double three structure with sub-division of 3-3-3 corrective swings in each leg. Down from 11171.55 high, the initial decline to 10276.3 low ended intermediate wave (W) as a Flat. Then the bounce to 10637.8 high ended intermediate wave (X) bounce. And the decline to 9951.9 low ended intermediate wave (Y) of ((4)) as Elliott Wave Flat.

Up from 9951.9 low, primary wave ((5)) remains in progress as impulse where intermediate wave (1), (3) & (5) are expected to unfold in 5 waves advance within lesser degree cycles. Whereas intermediate wave (2) & (4) are expected to unfold in 3 waves corrective sequence in lesser degree cycles. Above from 9951.9 low, the rally higher to 10929.2 high ended intermediate wave (1) in 5 waves structure. Down from there, the pullback to 10404.62 low ended intermediate wave (2) in 3 swings.

Above from there, the index is nesting in intermediate wave (3) higher. Where Minor wave 1 ended at 10893.25. And the Minor wave 2 ended at 10557.7 low. Near-term focus remains towards 11458.50-11584.44 100%-123.6% Fibonacci extension area of Minute wave ((i))-((ii)) to end the lesser degree Minutte wave (i). Later on, the index is expected to do a pullback in Minutte wave ((ii)) in 3, 7 or 11 swings before further upside is seen. We don’t like selling the index and prefer more upside as far as a pivot from 10404.62 low stays intact.