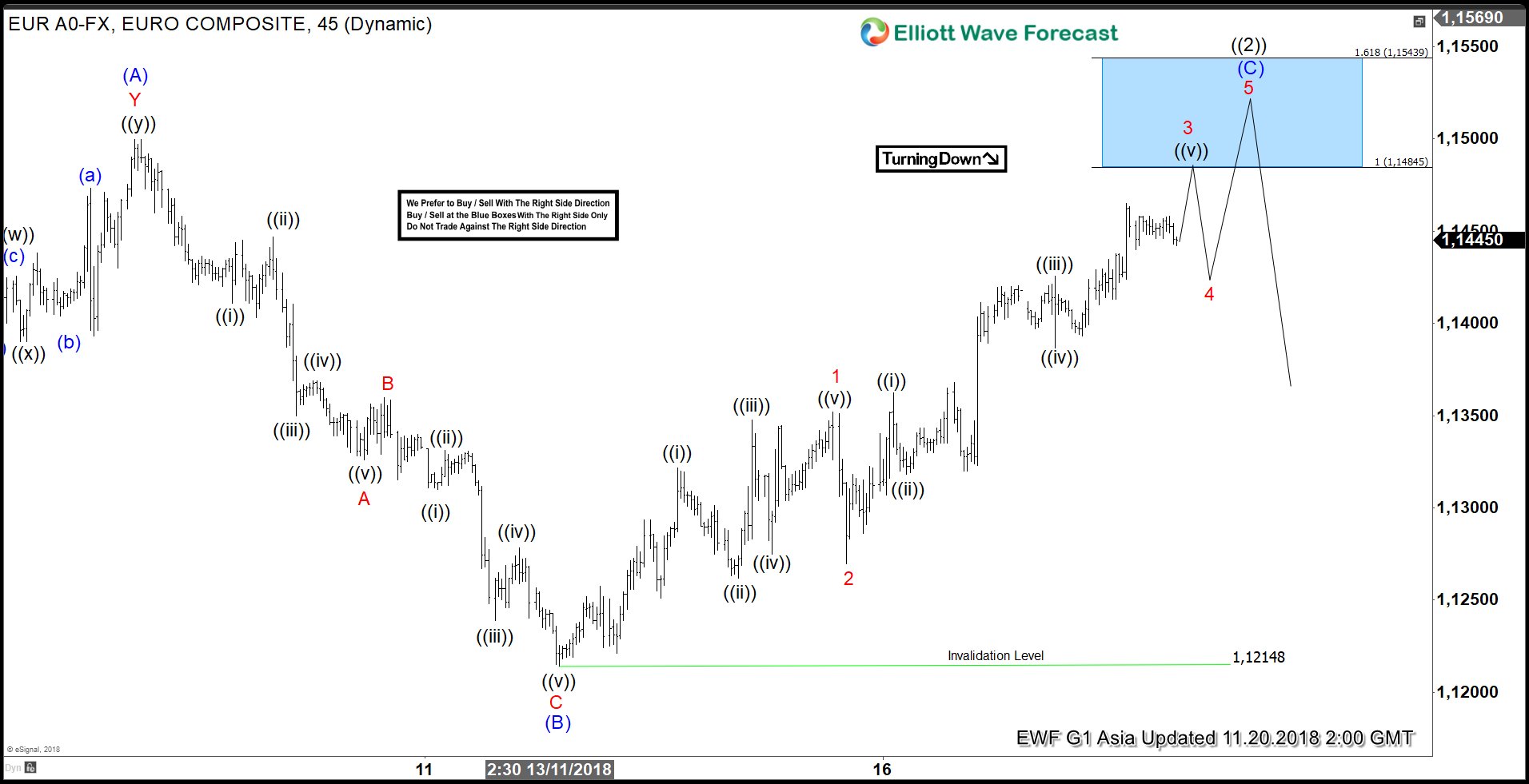

Short Term Elliott Wave View on EURUSD suggests that pair is currently in Primary wave ((2)) rally to correct cycle from Sept 24 high (1.1815) before the decline resumes. Internal of Primary wave ((2)) is unfolding as a Flat Elliott Wave structure where Intermediate wave (A) ended at 1.15 and Intermediate wave (B) ended at 1.1214. A Flat is a 3-3-5 Elliott Wave structure, thus we should expect Intermediate wave (C) to be unfolding as 5 waves.

Intermediate wave (C) rally higher is taking the form of a 5 waves impulse Elliott Wave structure. Minor wave 1 of (C) ended at 1.135 and Minor wave 2 of (C) ended at 1.127. Near term, expect the pair to end Minor wave 3 of (C) soon, then it should pullback in Minor wave 4 of (C) before doing another leg higher in Minor wave 5. The move in Minor wave 5 should also end Intermediate wave (C) with projected target at 1.148 – 1.154.

More important than the target area however is the momentum divergence. Minor wave 5 should show momentum divergence with Minor wave 3 before pair ends the 5 waves move. As far as momentum does not show any divergence, we can assume that EURUSD still remains to be in Minor wave 3. As far as pivot at Sept 24 high (1.1815) remains intact, pair is expected to resume lower or at least pullback in 3 waves once the 5 waves move is over. We don’t like buying the pair.