Welcome traders, today we will look at a couple of Apple (APPL) charts. After plunging almost 10% on January 3rd, has the tech giant reached a bottom? And do we really have to depend on news to be on the right side of the market?. The following analysis will show you how profitable and efficient it can be to trade with our philosophy and basic Elliott Wave analysis.

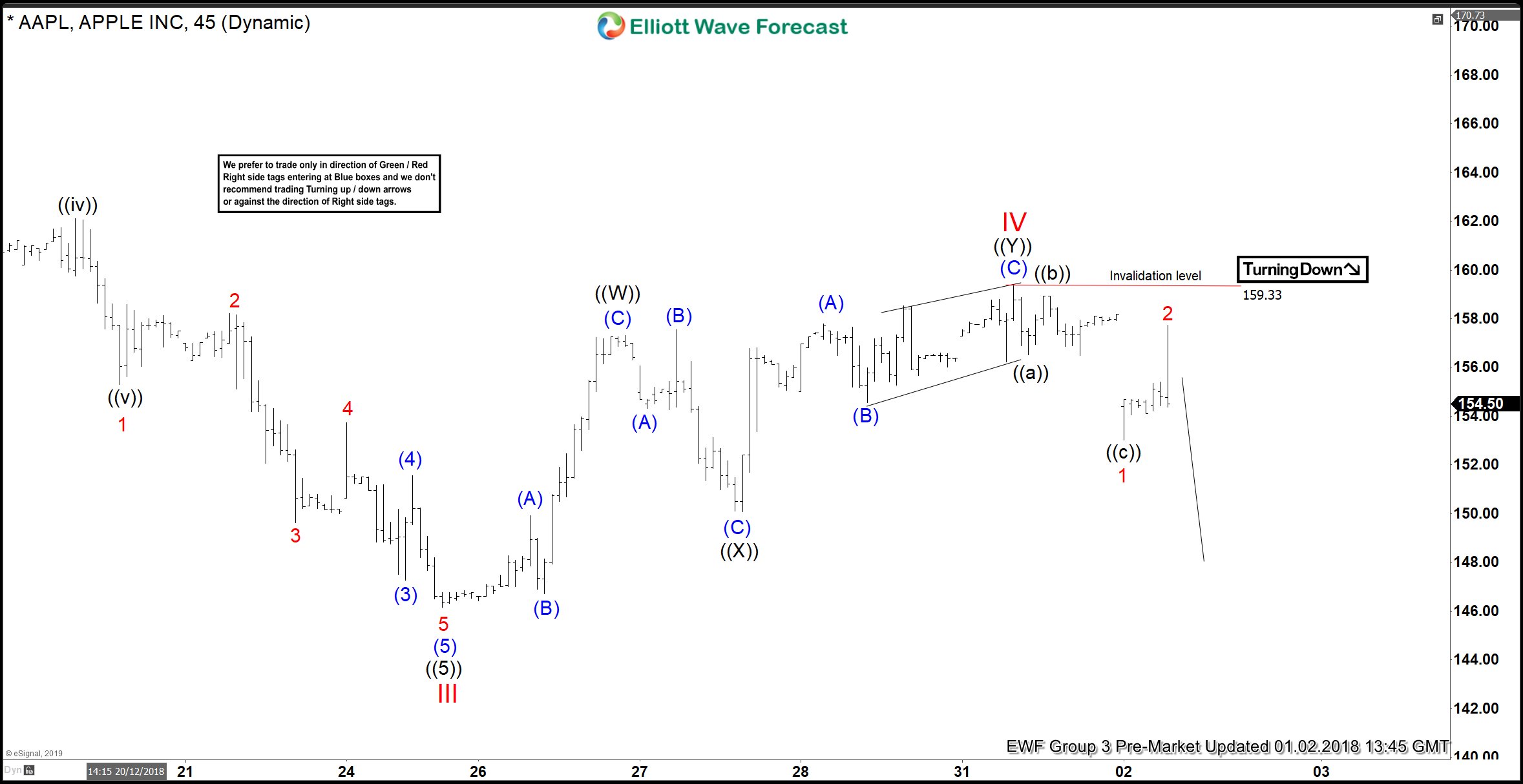

First of all, we start with Apple’s 45 minute chart from the 2nd of January 2018 presented to our members. At the time, we maintained a bearish perspective due to our Elliott Wave analysis. Our count suggested an impulsive 5 wave move cycle starting from October the 3rd. Consequently, with a proposed wave IV top, a final wave V was to start developing at any time.

With our aggressive approach, our members are encouraged to act accordingly with the right side of the market. With this being said, our members had no reason whatsoever to enter a long position in the near term for Apple. The stock missed equal leg target area off ((W)) – ((X)) from 12.25.2018 low by $2 and ended wave IV correction at $159.49

APPL 01.03.2018 45 Min Chart Elliott Wave Analysis

Below you can see an updated chart of APPL from January 6 presented to our members. Although our Elliott Wave count changed, our stance proved extremely valuable. Now we believe the decline from last week is part of a more complex nest within wave III. Nevertheless, it is still within the cycle from October 3rd favoring the continuation of further downside.

Patience and continuous adaptation to the market moves, now presents us with an opportunity to profit. We now have a blue box target area of 152.4-156.48 which represents an equal leg target area off of ((W)) & ((X)). Sellers should appear in this area and push the stock lower or pullback in 3 waves at least. A mapped entry, an invalidation level set up, the right side, add up to great trading opportunities. Above all, waiting for the right signals, puts the odds on our favor.

APPL 01.06.2018 45 Min Chart Elliott Wave Analysis

*Note : Keep in mind the market is dynamic and the presented view might have changed after the post was published.

Trading success is a journey and you will never be perfect at it, but you can always master your reaction to the market.