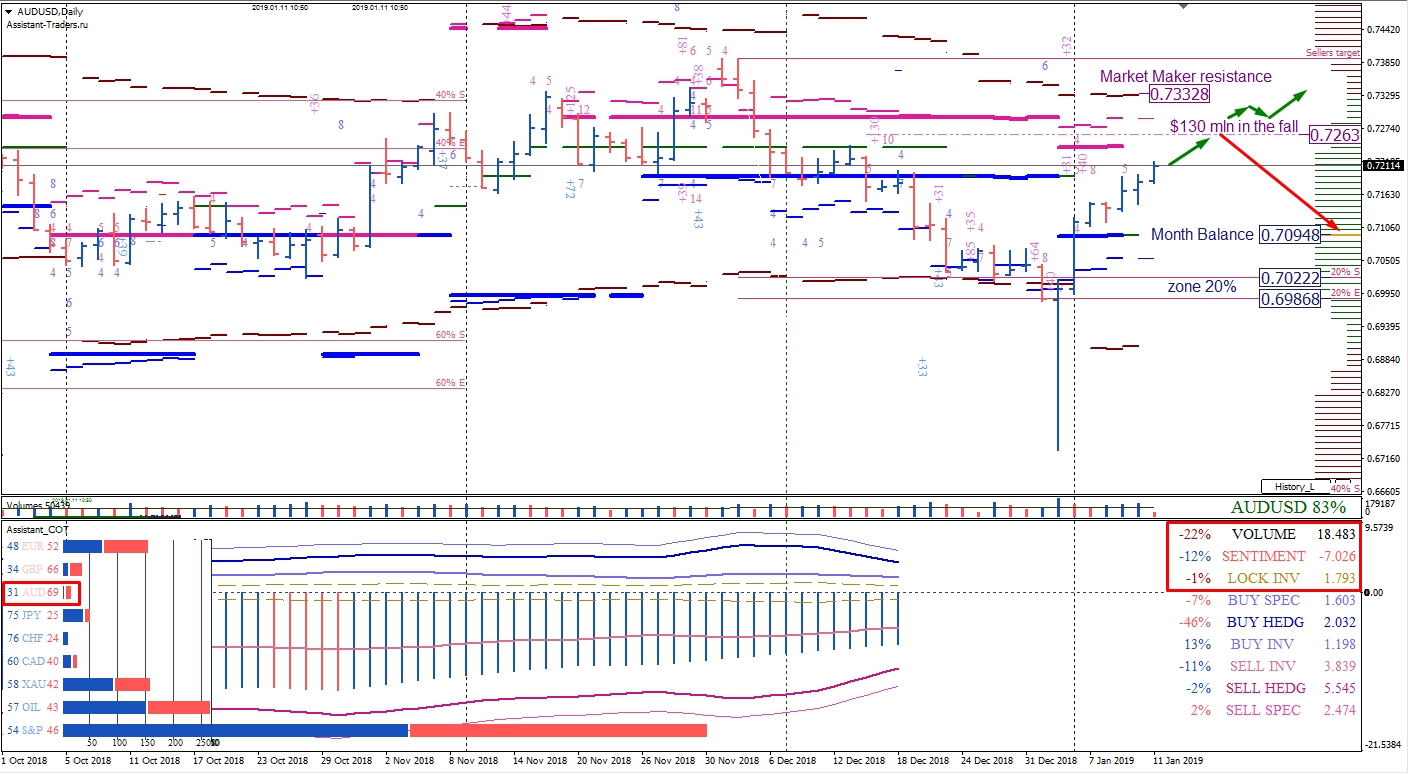

The investment of the accountable participants of the options and futures markets for AUDUSD decreased by 22%. Total cash investment in AUDUSD in cash equivalent amounted to $ 18 billion 483 million.

The net preponderance of bears for the previous reporting week decreased by 12%. The total value of the sellers cash superiority was $ 7 billion 26 million.

The number of locked positions of investors increased by 1%. The ratio of cash investments for AUD / USD among SMART MONEY is as follows: 31% of buyers and 69% of sellers.

The closest support level when trading on a daily timeframe is the monthly market maker balance (0.7094).

The next target of the decline is the long-term area of 20% of sellers (0.7022-0.6986).

The optional increase level of $ 130 million for a fall (0.7263) is the closest current resistance level.

The next resistance on the daily timeframe is the monthly market maker resistance level (0.7332).

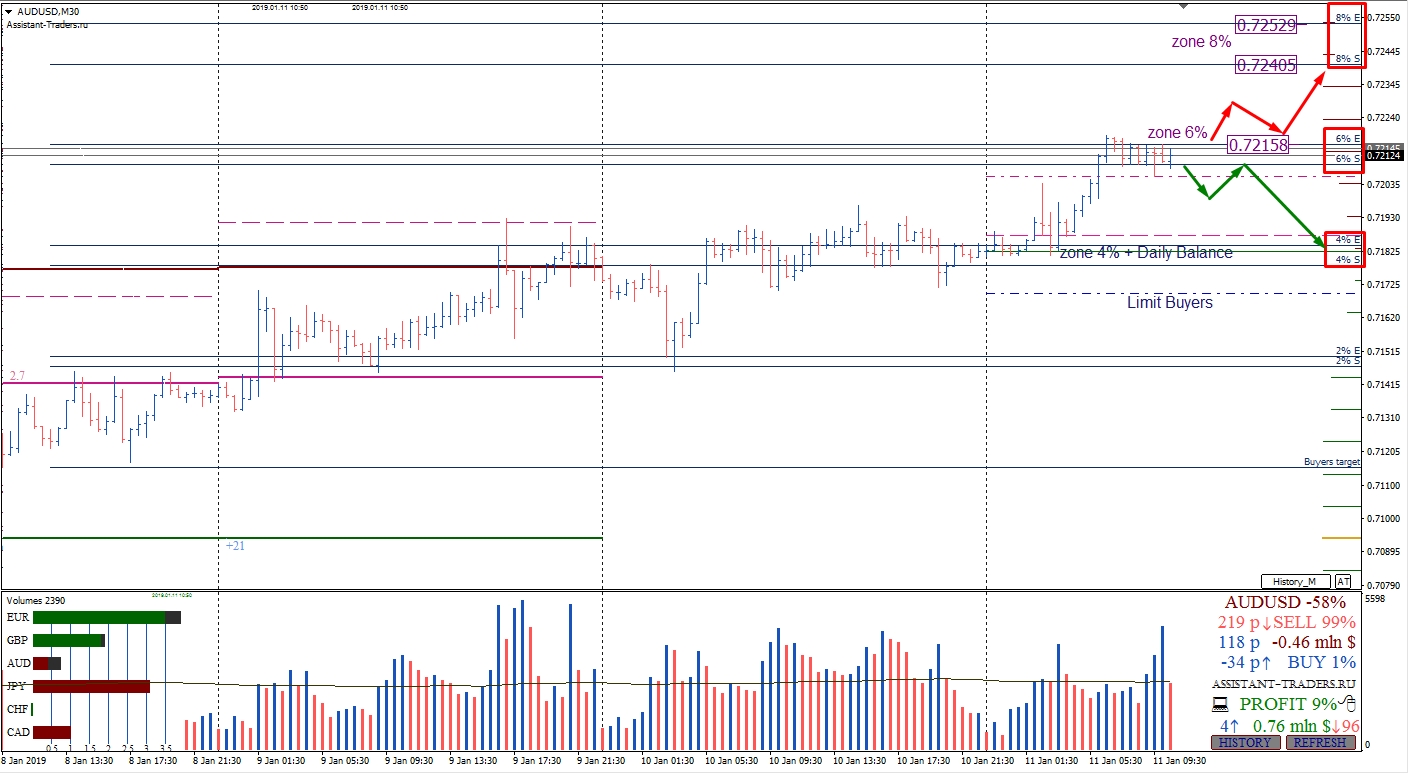

The key support area on Friday, January 11 is the zone of 4% of buyers (0.7184-0.7178).

If we fix below the 2% zone, we expect a decline to the level of limit buyers (0.7169).

The closest resistance area today is the 6% zone (0.7215-0.7209).

A detailed analytical review of the major currency pairs of the Forex market, Bitcoin and Ethereum cryptocurrencies, WTI crude oil, gold index, and S&P500 stock index is further on YouTube channel.

Dmitry Zeland, analyst at a brokerage company MTrading.