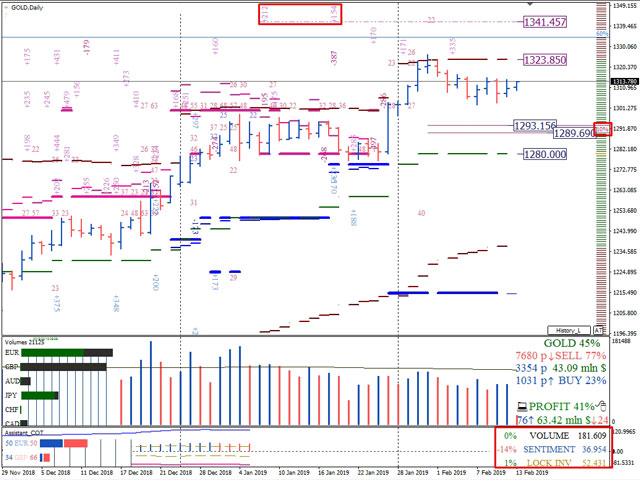

Cash investments of the “owners of the markets” in derivatives for gold of the CME Group exchange amounted to $ 181 billion 609 million. Capitalization of investments increased by less than 1%.

The net advantage of bullish positions declined by 14%. The total net overweight of XAUUSD buyers totaled $ 36 billion 954 million.

The overall investment ratio of SMART MONEY in Gold is as follows: 60% of buyers and 40% of sellers.

The first goal of an increase on the daily timeframe is the monthly resistance level of the market maker, which is located at a quote of 1323.85.

The next important resistance is the monthly option level at the quotation 1341.45.

The immediate support in doing business within the current option month is the zone of 10% of sellers (1293.15-1289.69).

Subsequent support is the monthly balance of the market maker 1280.00.

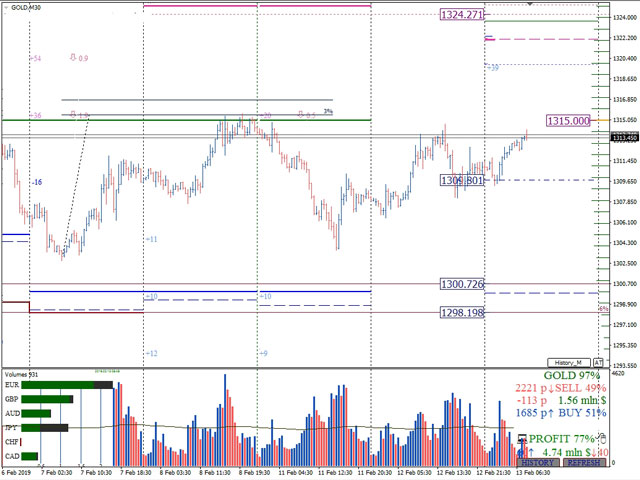

The immediate key support for today is the level of limit buyers, which is located at a price mark of 1309.80.

The subsequent support for Wednesday, February 13, is the 6% zone (1300.72-1298.19).

The first growth target for the current working day is the weekly market maker balance (1315.00).

The next target for today is the optional level of growth of $ 54 million to reduce (1324.71).

Dmitry Zeland, analyst at a brokerage company MTrading.