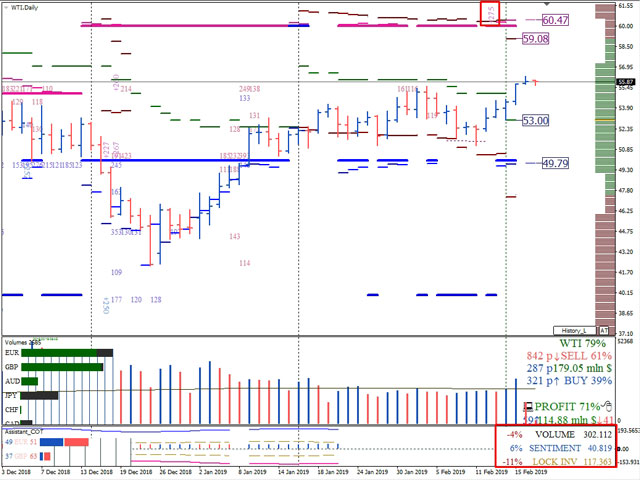

The total capitalization of investing cash in derivatives for Crude Oil was $ 302 billion 112 million. The decrease in capitalization over the previous reporting week was 4%.

The superiority of bull positions in monetary terms amounted to $ 40 billion 819 million. An increase in the predominance of bulls was 4%.

The decrease in the locked positions of investors at the same time was 11%.

The total cash investment in USOIL indicates a bullish capitalization advantage: 57% of buyers and 43% of sellers.

The closest important resistance level on the daily timeframe is the monthly market maker resistance level at 59.08.

The next target of the increase is the premium level of the weekly hedger resistance area (60.47).

The nearest long-term support level is the monthly market maker balance (53.00).

The next level of support is the premium level of the weekly customer support area (49.79).

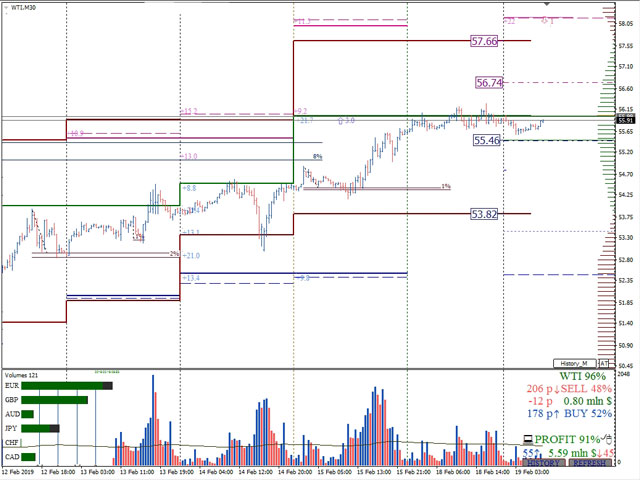

The key level for the trading on Tuesday, February 19, is the level of limit buyers (55.46).

The immediate goal of growth is the level of limit orders for sale (56.74).

The next goal of the increase is the level of the loss beginning of the seller of weekly option contracts (57.66).

The target target for the decline is the weekly level of market maker support (53.82).

Dmitry Zeland, analyst at a brokerage company MTrading.